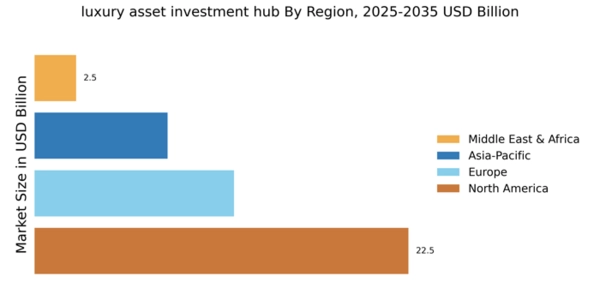

North America : Leading Luxury Investment Market

North America is poised to maintain its leadership in the luxury asset investment market, holding a significant market share of 22.5 in 2024. The region's growth is driven by increasing disposable incomes, a robust consumer base, and a growing interest in luxury goods as investment vehicles. Regulatory support for high-value asset transactions further enhances market dynamics, attracting both domestic and international investors. The competitive landscape is characterized by the presence of major players such as Tiffany & Co. (US), LVMH (FR), and Kering (FR). The United States stands out as the leading country, with a strong demand for luxury brands and a well-established retail infrastructure. This environment fosters innovation and collaboration among key players, ensuring that North America remains a pivotal hub for luxury asset investments.

Europe : Cultural Epicenter of Luxury

Europe, with a market size of 12.0, is a cultural epicenter for luxury asset investments, driven by its rich heritage and established luxury brands. The region benefits from a strong regulatory framework that supports high-value transactions, making it an attractive destination for investors. The increasing trend of luxury goods as investment assets is further fueled by a growing affluent population and a shift towards sustainable luxury practices. Leading countries such as France, Italy, and Switzerland dominate the market, housing iconic brands like Chanel (FR), Prada (IT), and Richemont (CH). The competitive landscape is vibrant, with numerous luxury houses continuously innovating to meet evolving consumer preferences. This dynamic environment positions Europe as a key player in The luxury asset investment hub market.

Asia-Pacific : Emerging Luxury Investment Hub

Asia-Pacific is emerging as a significant player in the luxury asset investment market, with a market size of 8.0. The region's growth is propelled by rising disposable incomes, a burgeoning middle class, and increasing interest in luxury goods as investment opportunities. Regulatory frameworks are evolving to support high-value transactions, enhancing investor confidence and market accessibility. Countries like China and Japan are at the forefront of this growth, with a strong presence of luxury brands and a growing appetite for high-end investments. The competitive landscape is marked by both established players and new entrants, creating a dynamic market environment. This rapid growth positions Asia-Pacific as a vital region for luxury asset investments, attracting global attention.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa, with a market size of 2.5, are witnessing a gradual rise in luxury asset investments. The region's growth is driven by increasing wealth among high-net-worth individuals and a growing interest in luxury goods as investment assets. Regulatory initiatives aimed at enhancing market transparency and investor protection are also contributing to this upward trend. Countries like the UAE and South Africa are leading the charge, with a growing number of luxury brands establishing a presence. The competitive landscape is evolving, with both local and international players vying for market share. This emerging market potential positions the Middle East and Africa as a region to watch in the luxury asset investment space.