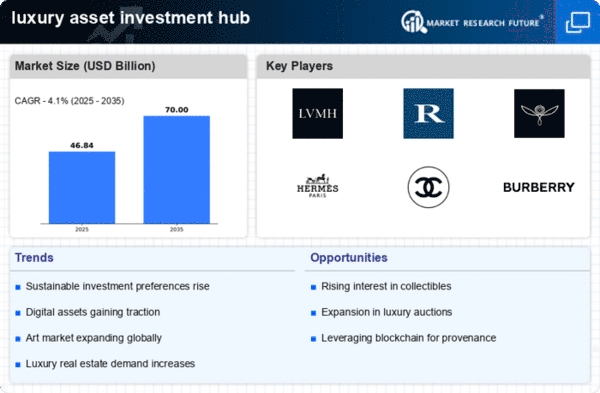

The luxury asset investment hub market is characterized by a dynamic competitive landscape, driven by a confluence of innovation, strategic partnerships, and a growing emphasis on sustainability. Major players such as LVMH (FR), Richemont (CH), and Kering (FR) are at the forefront, each adopting distinct strategies to enhance their market positioning. LVMH (FR) continues to leverage its extensive portfolio of luxury brands, focusing on digital transformation and e-commerce expansion to capture a broader consumer base. Meanwhile, Richemont (CH) emphasizes the integration of artisanal craftsmanship with modern technology, thereby appealing to a niche market that values heritage alongside innovation. Kering (FR) has been proactive in sustainability initiatives, aiming to set industry standards that resonate with environmentally conscious consumers, thus shaping a competitive environment that increasingly prioritizes ethical practices.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure appears moderately fragmented, with a blend of established luxury houses and emerging brands vying for consumer attention. This fragmentation allows for diverse offerings, yet the collective influence of key players like Chanel (FR) and Burberry (GB) remains substantial, as they continue to set trends that others follow.

In November 2025, Chanel (FR) announced a strategic partnership with a leading tech firm to develop an augmented reality (AR) shopping experience. This initiative is poised to revolutionize the consumer shopping journey, allowing customers to virtually try on products before purchase, thereby enhancing engagement and potentially increasing conversion rates. Such a move underscores Chanel's commitment to integrating cutting-edge technology into its retail strategy, which may redefine customer interactions in the luxury sector.

In October 2025, Burberry (GB) unveiled its new sustainability roadmap, which includes a commitment to achieving carbon neutrality across its supply chain by 2030. This ambitious plan not only positions Burberry as a leader in sustainable luxury but also reflects a broader industry trend towards environmental responsibility. The strategic importance of this initiative lies in its potential to attract a growing demographic of eco-conscious consumers, thereby enhancing brand loyalty and market share.

In September 2025, Tiffany & Co. (US) launched a new collection featuring ethically sourced diamonds, reinforcing its commitment to responsible luxury. This strategic move is indicative of a larger trend within the luxury asset investment hub market, where consumers increasingly demand transparency and ethical practices from brands. By aligning its product offerings with consumer values, Tiffany & Co. is likely to strengthen its competitive edge in a crowded marketplace.

As of December 2025, the luxury asset investment hub market is witnessing a pronounced shift towards digitalization, sustainability, and the integration of artificial intelligence (AI) in operations. Strategic alliances are becoming increasingly pivotal, as companies collaborate to enhance their technological capabilities and sustainability efforts. The competitive differentiation is evolving from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that future success in the luxury sector will hinge on a brand's ability to adapt to changing consumer expectations and leverage technological advancements.

Leave a Comment