Growing Focus on Cost-Effective Solutions

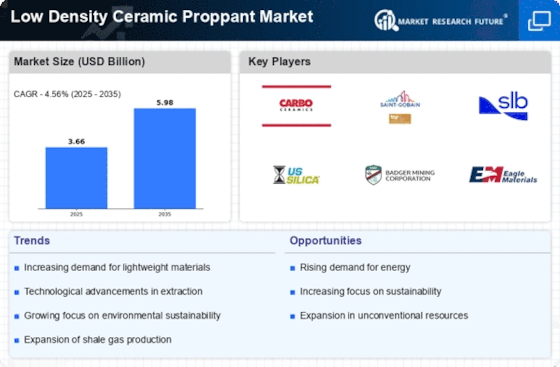

In the Low Density Ceramic Proppant Market, there is a notable shift towards cost-effective solutions that do not compromise on performance. As operators face budget constraints, the demand for proppants that offer a balance between cost and efficiency is rising. Low density ceramic proppants, known for their lightweight properties, can reduce transportation and handling costs, making them an attractive option for operators. Market data suggests that the adoption of these proppants can lead to significant savings in overall operational expenses. This trend indicates a growing awareness among industry players about the importance of optimizing costs while maintaining high productivity levels, thereby driving the Low Density Ceramic Proppant Market forward.

Rising Demand for Unconventional Resources

The Low Density Ceramic Proppant Market is witnessing a rise in demand driven by the exploration and production of unconventional resources such as shale gas and tight oil. These resources require advanced fracturing techniques to unlock their potential, and low density ceramic proppants are increasingly being utilized to achieve optimal results. The unique properties of these proppants facilitate better fracture conductivity, which is essential for the effective extraction of hydrocarbons from unconventional formations. Market analysis indicates that the shift towards unconventional resources is likely to continue, thereby sustaining the demand for low density ceramic proppants in the coming years. This trend underscores the critical role of the Low Density Ceramic Proppant Market in supporting the energy sector's evolution.

Increasing Oil and Gas Exploration Activities

The Low Density Ceramic Proppant Market is experiencing a surge in demand due to the increasing exploration activities in oil and gas sectors. As energy companies seek to maximize extraction from existing wells and explore new reserves, the need for effective proppants becomes paramount. The use of low density ceramic proppants enhances the efficiency of hydraulic fracturing, allowing for better permeability and conductivity in reservoirs. This trend is supported by data indicating that the number of active drilling rigs has shown a steady increase, suggesting a robust market for proppants. Consequently, the Low Density Ceramic Proppant Market is poised for growth as companies invest in advanced technologies to optimize their extraction processes.

Regulatory Support for Enhanced Recovery Techniques

The Low Density Ceramic Proppant Market is benefiting from increasing regulatory support for enhanced oil recovery techniques. Governments are recognizing the importance of maximizing resource extraction while ensuring environmental sustainability. This has led to the implementation of policies that encourage the use of advanced proppants in hydraulic fracturing processes. As regulations evolve, operators are more inclined to adopt low density ceramic proppants, which are designed to improve recovery rates and reduce environmental impact. The alignment of regulatory frameworks with industry needs suggests a favorable environment for the growth of the Low Density Ceramic Proppant Market, as companies seek to comply with new standards while enhancing their operational efficiency.

Technological Innovations in Proppant Manufacturing

Technological advancements in the manufacturing of proppants are significantly influencing the Low Density Ceramic Proppant Market. Innovations such as improved sintering processes and the development of new materials are enhancing the performance characteristics of low density ceramic proppants. These advancements not only improve the strength and durability of the proppants but also contribute to their lightweight nature, which is advantageous for transportation and application. As manufacturers continue to invest in research and development, the market is likely to see a proliferation of high-performance proppants that meet the evolving needs of the industry. This focus on innovation is expected to drive the Low Density Ceramic Proppant Market, as operators seek to leverage the latest technologies to enhance their hydraulic fracturing operations.