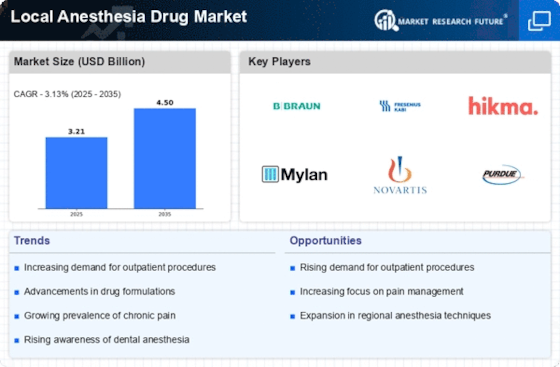

Increasing Surgical Procedures

The rise in surgical procedures across various medical specialties is a primary driver for the Local Anesthesia Drug Market. As more patients opt for elective surgeries, the demand for effective local anesthesia increases. In 2025, it is estimated that the number of outpatient surgeries will reach approximately 60 million, necessitating a robust supply of local anesthetics. This trend is particularly evident in fields such as dentistry, orthopedics, and dermatology, where local anesthesia is preferred for its efficacy and safety. The Local Anesthesia Drug Market is likely to benefit from this surge, as healthcare providers seek reliable anesthetic options to enhance patient comfort and satisfaction during procedures.

Rising Incidence of Chronic Pain Conditions

The increasing prevalence of chronic pain conditions is a notable driver for the Local Anesthesia Drug Market. Conditions such as arthritis, neuropathic pain, and fibromyalgia are becoming more common, leading to a heightened need for effective pain management solutions. In 2025, it is projected that over 20% of the population will experience chronic pain, creating a substantial market for local anesthetics. Healthcare providers are increasingly turning to local anesthesia as a viable option for managing pain, particularly in outpatient settings. This trend is likely to propel the Local Anesthesia Drug Market forward, as more patients seek relief from chronic pain through localized treatment options.

Regulatory Support for Anesthetic Innovations

Regulatory bodies are increasingly supporting the development and approval of innovative local anesthetics, which is a significant driver for the Local Anesthesia Drug Market. Initiatives aimed at expediting the approval process for new anesthetic formulations and delivery methods are fostering a more dynamic market environment. In 2025, several new local anesthetic agents are anticipated to receive regulatory approval, expanding the options available to healthcare providers. This regulatory support not only encourages research and development but also enhances competition within the Local Anesthesia Drug Market, ultimately benefiting patients through improved anesthetic choices.

Technological Advancements in Anesthesia Delivery

Technological innovations in anesthesia delivery systems are significantly influencing the Local Anesthesia Drug Market. The introduction of advanced delivery methods, such as computer-controlled local anesthetic delivery systems, enhances precision and reduces the risk of complications. These systems allow for more accurate dosing and improved patient outcomes. Furthermore, the integration of ultrasound guidance in administering local anesthesia has shown to increase the effectiveness of the drugs used. As these technologies become more prevalent, the Local Anesthesia Drug Market is expected to expand, driven by the demand for safer and more efficient anesthesia solutions.

Growing Preference for Minimally Invasive Procedures

The shift towards minimally invasive procedures is reshaping the landscape of the Local Anesthesia Drug Market. Patients and healthcare providers alike are favoring techniques that reduce recovery time and minimize surgical trauma. Local anesthesia plays a crucial role in these procedures, allowing for effective pain management without the need for general anesthesia. As the number of minimally invasive surgeries continues to rise, the demand for local anesthetics is expected to follow suit. This trend not only enhances patient satisfaction but also contributes to the overall growth of the Local Anesthesia Drug Market, as more practitioners adopt these techniques.