Emergence of Zoonotic Diseases

The increasing incidence of zoonotic diseases, which can be transmitted from animals to humans, is a critical driver for the Livestock Vaccine Market. Recent outbreaks have highlighted the need for robust vaccination programs to mitigate risks associated with these diseases. For instance, diseases such as avian influenza and foot-and-mouth disease have prompted governments and health organizations to prioritize vaccination as a preventive measure. The World Health Organization has indicated that zoonotic diseases account for a significant percentage of emerging infectious diseases, emphasizing the importance of vaccination in livestock. This growing awareness and urgency surrounding zoonotic diseases are likely to propel the Livestock Vaccine Market forward as stakeholders seek to protect both animal and human health.

Growing Awareness of Food Safety

The rising consumer awareness regarding food safety and quality is significantly influencing the Livestock Vaccine Market. Consumers are increasingly concerned about the origins of their food and the health of the animals from which it is derived. This heightened awareness drives demand for vaccines that ensure livestock are healthy and free from diseases that could affect food safety. As a result, producers are more likely to implement comprehensive vaccination programs to meet consumer expectations and regulatory standards. The emphasis on food safety not only enhances public health but also supports the economic stability of the livestock sector. Consequently, the Livestock Vaccine Market is poised for growth as stakeholders respond to these evolving consumer demands.

Rising Demand for Animal Protein

The increasing The Livestock Vaccine Industry. As consumers seek more meat, dairy, and eggs, livestock production must intensify, necessitating effective vaccination strategies to ensure animal health and productivity. According to recent data, the livestock sector is projected to grow significantly, with meat consumption expected to rise by over 70% by 2050. This surge in demand compels farmers to adopt vaccination programs to prevent disease outbreaks that could jeopardize livestock health and production. Consequently, the Livestock Vaccine Market is likely to experience substantial growth as producers invest in vaccines to maintain herd health and meet consumer needs.

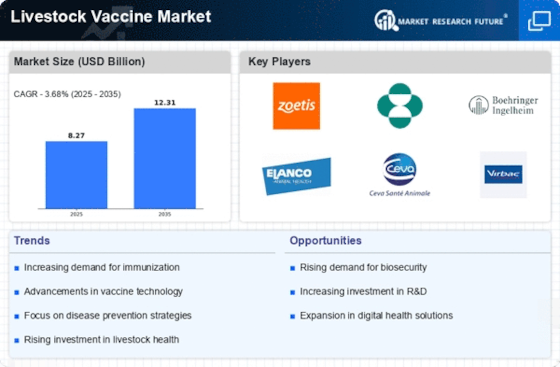

Advancements in Vaccine Technology

Technological innovations in vaccine development are transforming the Livestock Vaccine Market. The introduction of novel vaccine platforms, such as mRNA vaccines and vector-based vaccines, offers enhanced efficacy and safety profiles. These advancements enable quicker responses to emerging diseases and improve the overall effectiveness of vaccination programs. For example, the development of vaccines that provide broader protection against multiple strains of pathogens is becoming increasingly feasible. As a result, livestock producers are more inclined to invest in these advanced vaccines, which can lead to improved herd immunity and reduced disease prevalence. The ongoing research and development in vaccine technology are expected to significantly influence the Livestock Vaccine Market, fostering growth and innovation.

Government Initiatives and Funding

Government initiatives aimed at promoting livestock health and disease prevention are pivotal for the Livestock Vaccine Market. Many countries are implementing vaccination programs supported by funding and subsidies to encourage farmers to vaccinate their livestock. These initiatives often focus on eradicating specific diseases that pose a threat to animal health and food security. For instance, programs targeting diseases like brucellosis and bovine tuberculosis have received substantial government backing, which not only aids in disease control but also boosts the livestock sector's economic viability. As governments continue to prioritize animal health, the Livestock Vaccine Market is likely to benefit from increased funding and support for vaccination efforts.