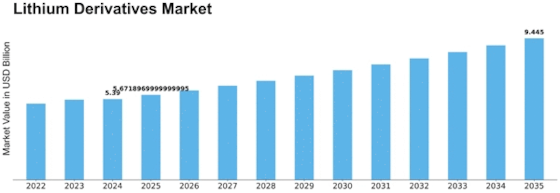

Lithium Derivatives Size

Lithium Derivatives Market Growth Projections and Opportunities

The Lithium Derivatives market is affected by several things that collectively determine its dynamics. Regulatory considerations combined with environmental consciousness are fundamental to operation and development of Lithium Derivatives markets. Additionally, there is increased focus on achieving sustainable energy solutions and eco-friendly practices hence influencing further advancements in this sector.

The global economic landscape is a vital determinant of the shape taken by Lithium Derivatives market. Economic factors including industrial output, consumer spending and electric vehicle demand affect directly how much forecasted sales will be for lithium derivative products in any given period. In periods when the economy grows there is usually an increase in production levels for electric vehicles as well as electronic devices leading to a growing demand for lithium derivatives. On the contrary, during downturns it leads into curtailment or reduction in industrial activities which negatively impacts on market dynamics.

Technological breakthroughs towards lithium extraction methods play a major role in marking out a market’s life cycle stage. Innovations regarding extraction techniques, purification procedures along with recycling technologies can lead to better efficiency plus cost-effectiveness with regard to production of lithium derivatives. To stay ahead with emerging industry needs through staying abreast with technological advancements companies investing into research and development make themselves more competitive in the Lithium Derivatives market.

The Lithium Derivatives market is largely influenced by supply chain dynamics that include raw material availability and pricing. The major source of lithium derivatives is lithium containing minerals such as spodumene and lithium brine. Changes in these commodity prices may therefore have effects on overall production costs and consequently market dynamics. Therefore, a reliable and efficient supply chain should be maintained to ensure continuous supply of lithium derivatives without disruptions and thus maintain market stability.

Global trade policies alongside geopolitical factors also affect the Lithium Derivatives markets. Tariffs, trade agreements, geopolitics might hinder movements of lithium as well as its derivatives internationally through affecting both supply and demand aspects. Players in the sector need to understand how to operate within this framework if they are to succeed in managing global trading within it.

Leave a Comment