Market Growth Projections

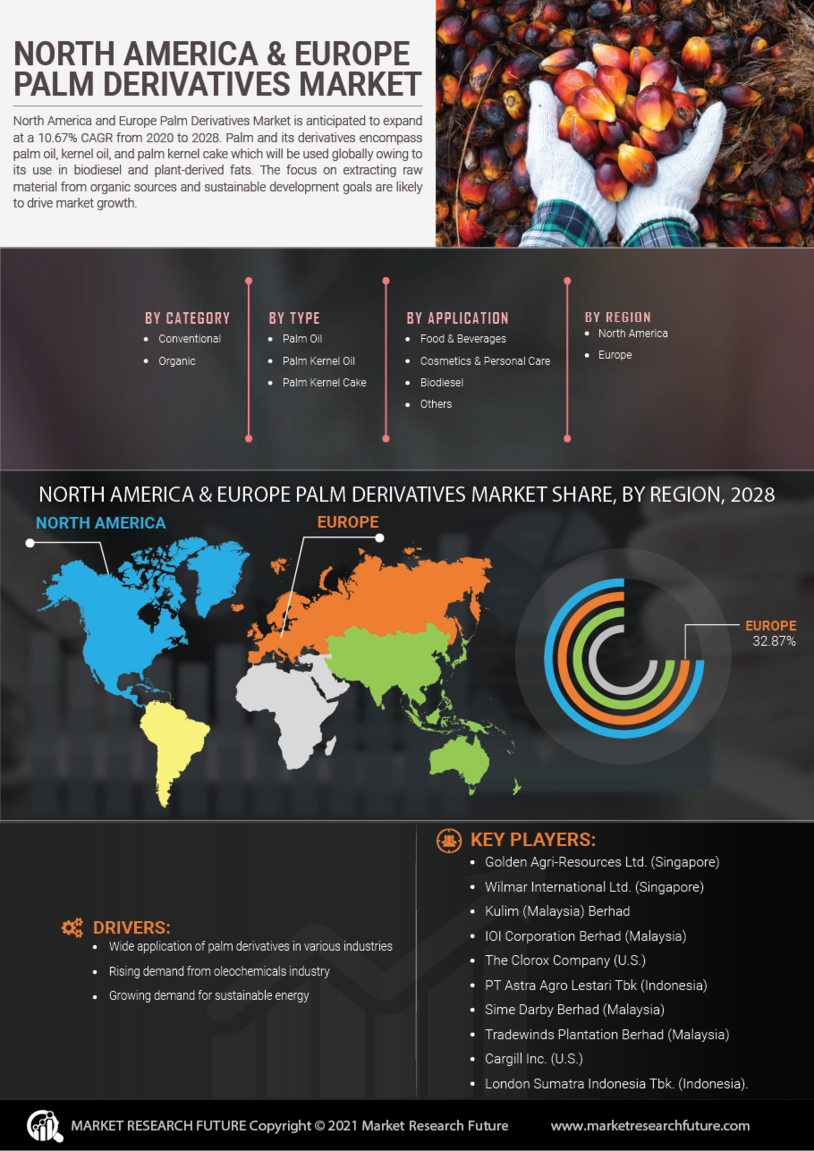

The North America and Europe Palm Derivatives Industry is poised for substantial growth, with projections indicating a market value of 235.94 USD Billion in 2024 and an impressive 541.32 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 7.84% from 2025 to 2035. Such projections highlight the increasing relevance of palm derivatives across various sectors, including food, cosmetics, and biofuels. The anticipated growth underscores the importance of strategic investments and innovation within the industry to capitalize on emerging opportunities.

Rising Demand for Sustainable Products

The North America and Europe Palm Derivatives Industry is experiencing a notable shift towards sustainability. Consumers increasingly prefer products derived from sustainable sources, prompting manufacturers to adopt eco-friendly practices. This trend is reflected in the growing demand for palm derivatives that meet sustainability certifications. For instance, the market is projected to reach 235.94 USD Billion in 2024, driven by this consumer preference. Companies that prioritize sustainability in their sourcing and production processes are likely to gain a competitive edge, as they align with the values of environmentally conscious consumers.

Expanding Applications in Food Industry

The North America and Europe Palm Derivatives Industry benefits from the expanding applications of palm derivatives in the food sector. These derivatives serve as emulsifiers, stabilizers, and texturizers, enhancing the quality and shelf life of various food products. As the food industry continues to innovate, the demand for palm derivatives is expected to rise. This trend is underscored by the market's anticipated growth to 541.32 USD Billion by 2035, reflecting a compound annual growth rate of 7.84% from 2025 to 2035. Manufacturers are increasingly investing in research and development to explore new applications, further driving market expansion.

Technological Advancements in Processing

Technological advancements in processing techniques are significantly impacting the North America and Europe Palm Derivatives Industry. Innovations in extraction and refining processes enhance the efficiency and quality of palm derivatives. These advancements not only improve yield but also reduce waste, aligning with sustainability goals. As a result, manufacturers are better positioned to meet the increasing demand for high-quality palm derivatives. The market's growth trajectory, projected to reach 541.32 USD Billion by 2035, suggests that continued investment in technology will be crucial for maintaining competitiveness in this evolving landscape.

Growing Health Consciousness Among Consumers

The North America and Europe Palm Derivatives Industry is influenced by the increasing health consciousness among consumers. As individuals become more aware of the nutritional aspects of their diets, there is a rising demand for healthier food options. Palm derivatives, known for their beneficial properties, are being incorporated into various health-oriented products. This shift is likely to contribute to the market's growth, as the industry adapts to meet the evolving preferences of health-conscious consumers. The projected market value of 235.94 USD Billion in 2024 indicates the potential for further expansion in response to these changing consumer behaviors.

Regulatory Support for Sustainable Practices

Regulatory frameworks in North America and Europe are increasingly supportive of sustainable practices within the North America and Europe Palm Derivatives Industry. Governments are implementing policies that encourage the use of sustainably sourced palm derivatives, promoting environmental stewardship. This regulatory support not only enhances market stability but also incentivizes companies to adopt sustainable sourcing practices. As the market is projected to grow at a CAGR of 7.84% from 2025 to 2035, the alignment of industry practices with regulatory expectations will likely play a pivotal role in shaping the future of palm derivatives.