Rising Demand for Immunoglobulins

The Global Blood Plasma Derivatives Market Industry experiences a notable surge in demand for immunoglobulins, primarily driven by their therapeutic applications in treating immune deficiencies and autoimmune disorders. As healthcare providers increasingly recognize the efficacy of immunoglobulins, the market is projected to reach 51.0 USD Billion in 2024. This growth is indicative of a broader trend towards personalized medicine, where immunoglobulins play a crucial role in patient care. The increasing prevalence of chronic diseases further fuels this demand, suggesting that the Global Blood Plasma Derivatives Market Industry is poised for sustained expansion.

Growing Awareness of Rare Diseases

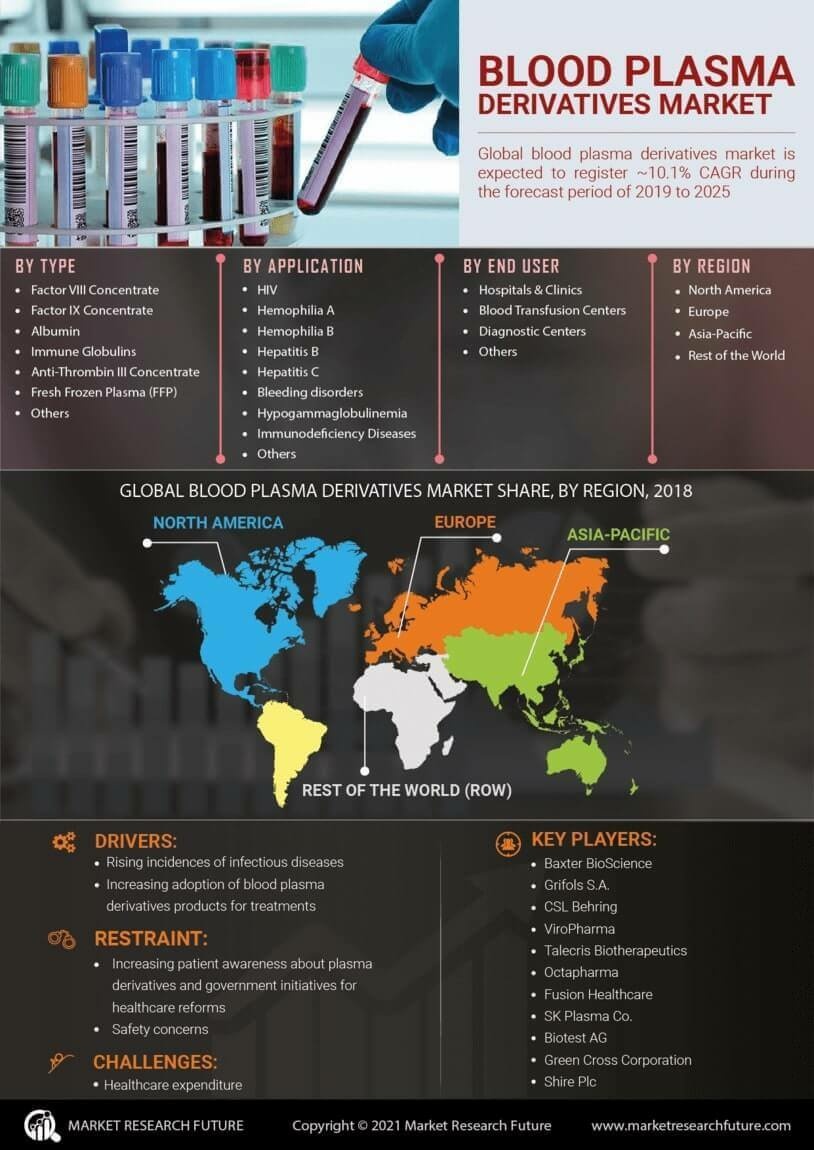

The Global Blood Plasma Derivatives Market Industry is witnessing an increase in awareness and diagnosis of rare diseases, which often require specialized plasma-derived therapies. As healthcare systems improve their capabilities to identify and treat these conditions, the demand for specific plasma derivatives, such as clotting factors and albumin, is expected to rise. This trend is likely to contribute to the market's projected compound annual growth rate of 8.52% from 2025 to 2035. The growing focus on rare diseases underscores the importance of plasma derivatives in modern medicine, positioning the Global Blood Plasma Derivatives Market Industry for significant growth.

Emerging Markets and Global Expansion

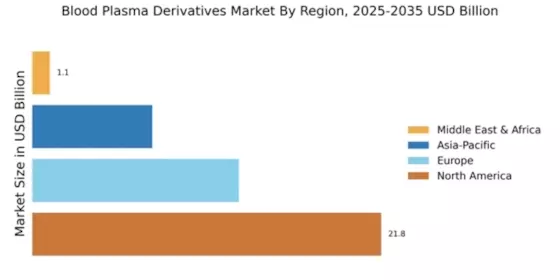

Emerging markets are playing a pivotal role in the growth of the Global Blood Plasma Derivatives Market Industry. Countries in Asia-Pacific and Latin America are experiencing rapid economic development, leading to increased healthcare spending and improved access to plasma-derived therapies. This trend is likely to drive demand for various plasma products, contributing to the overall market growth. As these regions continue to develop their healthcare infrastructure, the Global Blood Plasma Derivatives Market Industry is expected to expand significantly, reflecting the changing dynamics of global healthcare.

Regulatory Support for Plasma Products

Regulatory frameworks supporting the development and distribution of plasma-derived products are crucial for the Global Blood Plasma Derivatives Market Industry. Governments and health authorities are increasingly recognizing the therapeutic value of these products, leading to streamlined approval processes and enhanced funding for research and development. This supportive environment encourages innovation and investment in the sector, which is essential for meeting the rising global demand for plasma derivatives. As a result, the market is expected to thrive, with projections indicating a substantial increase in value over the coming years.

Advancements in Plasma Collection Technologies

Technological advancements in plasma collection and processing are significantly impacting the Global Blood Plasma Derivatives Market Industry. Innovations such as automated collection systems and improved separation techniques enhance the efficiency and safety of plasma donation. These advancements not only increase the yield of plasma derivatives but also improve donor experience, thereby attracting more individuals to donate. As a result, the market is likely to benefit from a more robust supply chain, supporting the anticipated growth trajectory towards 125.3 USD Billion by 2035. This evolution in technology indicates a promising future for the Global Blood Plasma Derivatives Market Industry.