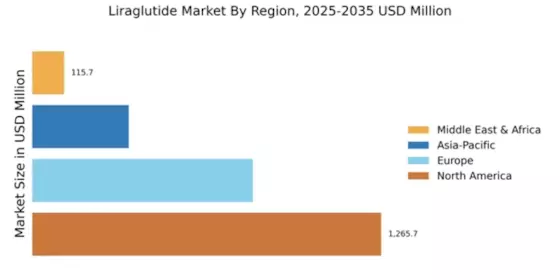

North America : Market Leader in Liraglutide

North America continues to lead the Liraglutide market, holding a significant share of 1265.74 million in 2024. The growth is driven by increasing obesity rates, rising diabetes prevalence, and a strong focus on innovative therapies. Regulatory support from agencies like the FDA has accelerated the approval of new treatments, enhancing market dynamics. The region's advanced healthcare infrastructure and high disposable income further fuel demand for Liraglutide products.

The competitive landscape in North America is robust, featuring key players such as Novo Nordisk, Eli Lilly, and Merck & Co. These companies are investing heavily in R&D to develop next-generation therapies. The U.S. remains the largest market, with Canada and Mexico also contributing to growth. The presence of established pharmaceutical companies ensures a steady supply of Liraglutide, catering to the increasing demand for diabetes management solutions.

Europe : Emerging Market Potential

Europe's Liraglutide market is projected to reach 800.0 million by 2025, driven by increasing awareness of diabetes management and obesity treatment. The region benefits from supportive healthcare policies and initiatives aimed at improving patient outcomes. Regulatory bodies like the EMA are actively promoting the use of GLP-1 receptor agonists, which include Liraglutide, as part of comprehensive diabetes care strategies. This regulatory environment is expected to enhance market growth significantly.

Leading countries in Europe include Germany, France, and the UK, where the demand for Liraglutide is on the rise. The competitive landscape features major players such as Sanofi and Boehringer Ingelheim, who are focusing on expanding their product portfolios. The presence of innovative therapies and a growing emphasis on personalized medicine are key factors driving the market. As healthcare systems evolve, the adoption of Liraglutide is expected to increase, further solidifying its market position.

Asia-Pacific : Rapid Growth Region

The Asia-Pacific Liraglutide market is estimated at 350.0 million, reflecting a growing awareness of diabetes and obesity issues. Factors such as increasing urbanization, lifestyle changes, and rising healthcare expenditure are driving demand for effective diabetes treatments. Regulatory bodies in countries like Australia and Japan are facilitating quicker approvals for innovative therapies, which is expected to boost market growth in the coming years.

Key players in the Asia-Pacific region include Eli Lilly and AstraZeneca, who are actively expanding their market presence. Countries like China and India are witnessing a surge in demand for Liraglutide, driven by rising diabetes prevalence. The competitive landscape is becoming increasingly dynamic, with local manufacturers also entering the market. As healthcare systems improve, the adoption of Liraglutide is anticipated to grow, addressing the urgent need for effective diabetes management solutions.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa Liraglutide market is valued at 115.74 million, with significant growth potential driven by increasing diabetes rates and healthcare improvements. The region faces challenges such as limited access to healthcare and varying regulatory environments, but initiatives to enhance healthcare infrastructure are underway. Governments are increasingly recognizing the importance of diabetes management, which is expected to catalyze market growth in the coming years.

Countries like South Africa and the UAE are leading the way in adopting Liraglutide therapies. The competitive landscape includes both multinational corporations and local players, creating a diverse market environment. As awareness of diabetes and obesity rises, the demand for effective treatments like Liraglutide is expected to increase, supported by ongoing healthcare reforms and investment in medical technologies.