Expansion of the Rubber Industry

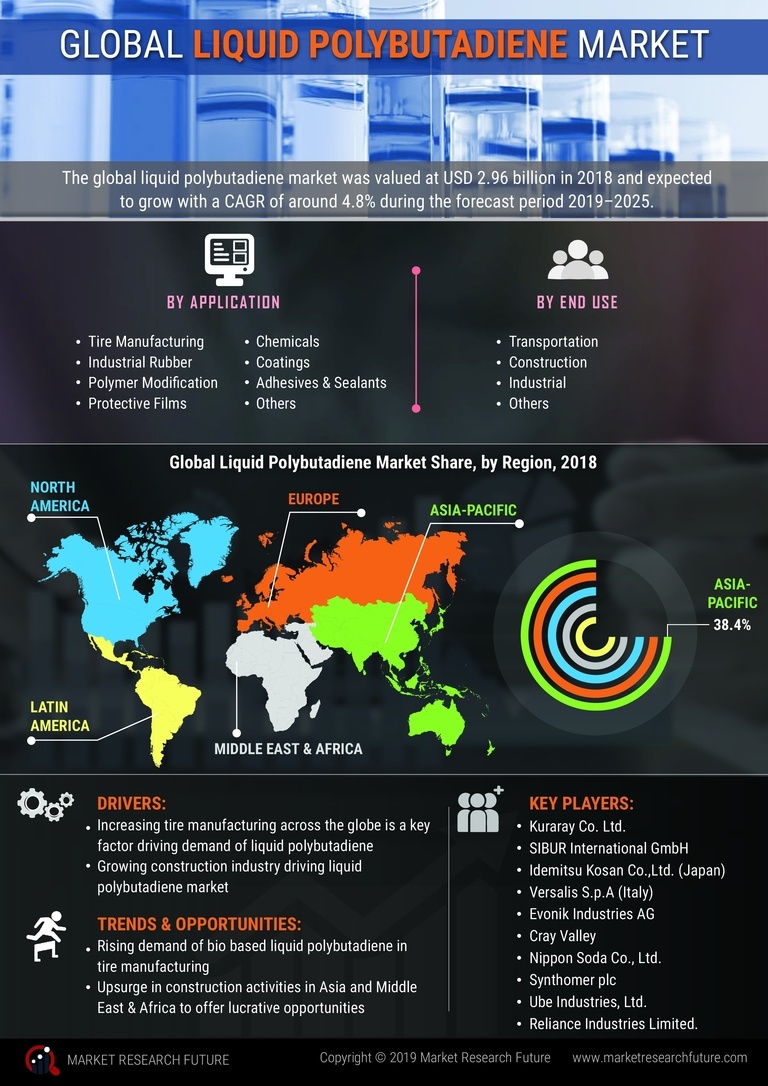

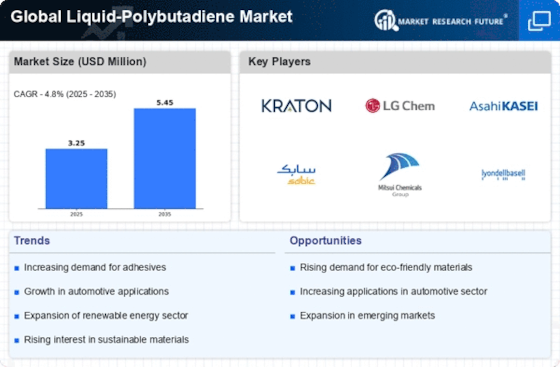

The rubber industry is undergoing substantial expansion, which is expected to significantly influence the liquid polybutadiene market. Liquid polybutadiene is a key ingredient in the production of synthetic rubber, which is widely used in tires, footwear, and various industrial applications. As the demand for synthetic rubber continues to grow, particularly in emerging markets, the Global Liquid-Polybutadiene Market is poised for growth. In 2025, the rubber industry is projected to expand at a compound annual growth rate (CAGR) of over 5%, driven by increasing consumer demand for durable and high-performance rubber products. This growth is likely to create new opportunities for liquid polybutadiene manufacturers, as they seek to meet the rising demand for innovative rubber solutions.

Growth in Adhesives and Sealants

The adhesives and sealants segment is witnessing significant growth, which is expected to positively impact the liquid polybutadiene market. This material is favored for its superior bonding capabilities and flexibility, making it ideal for various applications in construction, packaging, and automotive industries. In 2025, the demand for liquid polybutadiene in adhesives and sealants is anticipated to rise, driven by the increasing need for durable and high-performance products. The Global Liquid-Polybutadiene Market is likely to see a surge in applications as manufacturers innovate to meet the evolving needs of consumers. Additionally, the trend towards environmentally friendly adhesives may further bolster the market, as liquid polybutadiene can be formulated to meet stringent regulatory requirements while maintaining performance.

Rising Demand from Automotive Sector

The automotive sector is experiencing a notable increase in demand for liquid polybutadiene, primarily due to its advantageous properties such as high resilience and excellent elasticity. This material is increasingly utilized in the production of tires and various automotive components, which require materials that can withstand extreme conditions. In 2025, the automotive industry is projected to account for a substantial share of the liquid polybutadiene market, driven by the ongoing shift towards lightweight and fuel-efficient vehicles. The Global Liquid-Polybutadiene Market is likely to benefit from this trend, as manufacturers seek materials that enhance performance while reducing overall vehicle weight. Furthermore, the growing emphasis on sustainability within the automotive sector may lead to increased adoption of liquid polybutadiene, as it can contribute to the development of eco-friendly products.

Technological Innovations in Production

Technological advancements in the production of liquid polybutadiene are playing a crucial role in shaping the market landscape. Innovations in polymerization techniques and process optimization are enabling manufacturers to produce higher quality products with improved performance characteristics. In 2025, the Global Liquid-Polybutadiene Market is expected to benefit from these advancements, as they allow for greater efficiency and reduced production costs. Furthermore, the development of new formulations and blends is likely to enhance the versatility of liquid polybutadiene, opening up new applications across various industries. As manufacturers continue to invest in research and development, the market is anticipated to witness a wave of innovative products that cater to the evolving needs of consumers.

Increasing Focus on Sustainable Materials

The growing emphasis on sustainability is driving a shift towards the use of eco-friendly materials, including liquid polybutadiene. As industries seek to reduce their environmental footprint, the demand for sustainable alternatives is on the rise. In 2025, the Global Liquid-Polybutadiene Market is likely to see increased interest from manufacturers looking to develop products that align with sustainability goals. This trend is particularly evident in the automotive and construction sectors, where companies are actively seeking materials that can contribute to greener practices. The potential for liquid polybutadiene to be formulated with renewable resources may further enhance its appeal, positioning it as a viable option for environmentally conscious consumers and businesses alike.