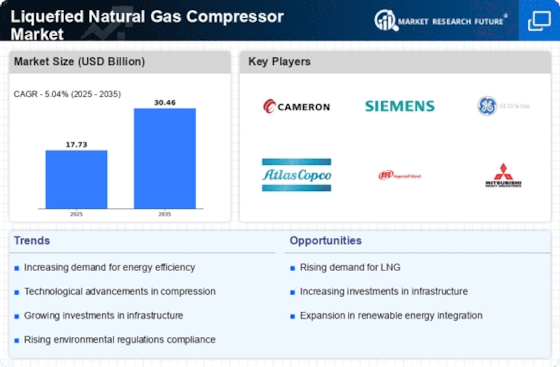

Rising LNG Exports

The rise in liquefied natural gas exports is a significant driver for the Liquefied Natural Gas Compressor Market. Countries rich in natural gas reserves are increasingly looking to export LNG to meet the growing energy needs of importing nations. The U.S. Energy Information Administration projects that U.S. LNG exports could reach 10 billion cubic feet per day by 2025. This increase in export activities necessitates the use of efficient compressors to ensure the liquefaction process is both cost-effective and environmentally friendly. As the global demand for LNG continues to rise, the Liquefied Natural Gas Compressor Market is poised for substantial growth, driven by the need for advanced compression solutions.

Technological Innovations

Technological innovations are transforming the Liquefied Natural Gas Compressor Market, leading to enhanced efficiency and performance. The advent of advanced materials and digital technologies has enabled the development of compressors that operate at higher pressures and lower energy consumption. For instance, the introduction of variable speed drives and advanced control systems has improved the operational efficiency of LNG compressors. As companies seek to optimize their operations and reduce costs, the demand for these innovative compressor technologies is expected to rise. This trend indicates a promising future for the Liquefied Natural Gas Compressor Market, as technological advancements continue to shape the landscape.

Infrastructure Development

Infrastructure development plays a crucial role in the expansion of the Liquefied Natural Gas Compressor Market. Investments in LNG terminals, pipelines, and storage facilities are essential for enhancing the supply chain of liquefied natural gas. According to recent reports, the global LNG infrastructure investment is expected to exceed 200 billion dollars by 2025. This surge in infrastructure development necessitates the deployment of advanced compressors to ensure efficient operations. As countries enhance their LNG infrastructure, the Liquefied Natural Gas Compressor Market is likely to experience significant growth, driven by the need for reliable and efficient compression solutions.

Increasing Demand for Clean Energy

The rising emphasis on clean energy sources is a pivotal driver for the Liquefied Natural Gas Compressor Market. As nations strive to reduce carbon emissions, natural gas is increasingly viewed as a transitional fuel. This shift is evidenced by the International Energy Agency's projections, which indicate that natural gas demand could rise by 30% by 2040. Consequently, the need for efficient liquefied natural gas compressors becomes paramount to facilitate the storage and transportation of this cleaner energy source. The Liquefied Natural Gas Compressor Market is thus positioned to benefit from this trend, as companies invest in advanced compressor technologies to meet the growing demand for liquefied natural gas.

Regulatory Frameworks and Policies

Regulatory frameworks and policies significantly influence the Liquefied Natural Gas Compressor Market. Governments worldwide are implementing regulations aimed at promoting cleaner energy sources and reducing greenhouse gas emissions. These policies often include incentives for the adoption of liquefied natural gas as a cleaner alternative to coal and oil. For example, the implementation of stricter emissions standards has led to increased investments in LNG infrastructure and compressor technologies. As regulatory support strengthens, the Liquefied Natural Gas Compressor Market is likely to see a surge in demand for compressors that comply with these evolving standards, driving market growth.