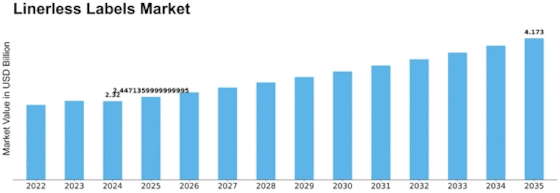

Linerless Labels Size

Linerless Labels Market Growth Projections and Opportunities

The Linerless Labels Market has grown and evolved rapidly in recent years. Linerless labels are growing due to changing customer tastes, technology advances, and sustainability concerns.

Linerless labels are growing due to need for sustainable packaging. Businesses and consumers worldwide are exploring alternatives to wasteful labeling techniques as environmental awareness develops. Linerless labels are eco-friendly because they can be applied without release liners, backing materials that are usually removed. This sustainability factor has increased uptake, especially in environmentally conscious industries.

Linerless labels also offer end-user operating benefits. These labels are cheaper without liners since they save on materials and waste disposal. Linerless technology simplifies labeling, improving manufacturer productivity. To achieve environmental and economic benefits, firms across sectors are increasingly using linerless labels in their packaging strategy.

Advances in technology shape the linerless label market. Label printing and application innovations have made linerless labels more feasible and high-quality. Advanced printing methods produce bright, high-quality label graphics that match brand owners' aesthetic needs. Linerless labels have also gained popularity due to reliable adhesive solutions that handle label adherence and application issues.

Market factors include rising need for variable information printing and product packaging traceability. Linerless labels enable changeable data like barcodes and QR codes to improve supply chain visibility and meet regulations. Pharmaceuticals, food and drinks, and logistics require precise and traceable product information for compliance and consumer safety, making this functionality crucial.

Another factor driving linerless labels is retail's changing landscape. E-commerce is growing, requiring efficient labeling solutions that can resist shipping and handling. Logistics and shipping companies favor linerless labels for their longevity and environmental resilience.

However, the linerless labels market faces issues such package reusability and the requirement for established rules. Addressing these difficulties will help linerless labels survive as the market grows.

In conclusion, environmental awareness, technology, operational efficiency, and retail dynamics affect the linerless labels industry. Linerless labels are used throughout sectors due to their operational benefits and desire for ecological packaging. The linerless labels market will develop and innovate as technology advances and market players overcome issues.

Leave a Comment