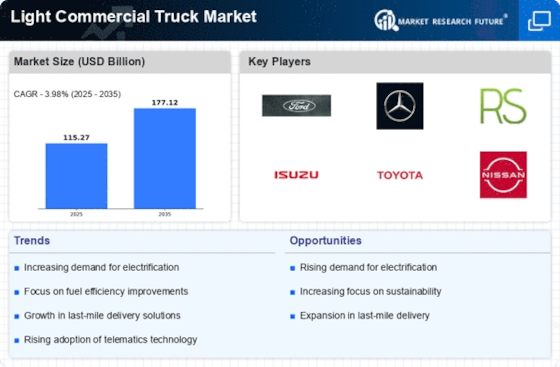

Shift Towards Electric Vehicles

The shift towards electric vehicles (EVs) is becoming a defining trend in the Light Commercial Truck Market. As environmental concerns gain prominence, businesses are increasingly considering electric light commercial trucks as a viable alternative to traditional diesel-powered vehicles. The growing availability of charging infrastructure and advancements in battery technology are making electric trucks more accessible and practical for commercial use. Market data indicates that the electric light commercial vehicle segment is expected to witness a compound annual growth rate of over 20% in the next few years. This transition not only aligns with sustainability goals but also offers potential cost savings in terms of fuel and maintenance. As a result, manufacturers are investing in the development of electric light commercial trucks to meet the evolving demands of the market.

Rising Demand for Last-Mile Delivery

The Light Commercial Truck Market is experiencing a notable surge in demand for last-mile delivery solutions. As urbanization continues to rise, businesses are increasingly seeking efficient transportation options to deliver goods directly to consumers. This trend is further fueled by the expansion of e-commerce, which has led to a significant increase in parcel deliveries. According to recent data, the last-mile delivery segment is projected to grow at a compound annual growth rate of over 10% in the coming years. Consequently, light commercial trucks are becoming essential for logistics companies aiming to meet consumer expectations for fast and reliable service. This shift not only enhances operational efficiency but also drives innovation within the Light Commercial Truck Market, as manufacturers develop vehicles tailored for urban environments.

Government Regulations and Incentives

Government regulations and incentives play a crucial role in shaping the Light Commercial Truck Market. Many governments are implementing stricter emissions standards to combat climate change, which encourages manufacturers to develop cleaner and more efficient vehicles. Additionally, various incentive programs are being introduced to promote the adoption of electric and hybrid light commercial trucks. For instance, tax credits and grants for businesses that invest in environmentally friendly vehicles are becoming more common. This regulatory landscape is likely to accelerate the transition towards sustainable transportation solutions, thereby influencing purchasing decisions within the Light Commercial Truck Market. As a result, manufacturers are increasingly focusing on innovation to comply with these regulations while meeting market demands.

Growth of Small and Medium Enterprises

The growth of small and medium enterprises (SMEs) is significantly impacting the Light Commercial Truck Market. SMEs are increasingly relying on light commercial trucks for their logistics and transportation needs, as these vehicles offer flexibility and cost-effectiveness. The rise of entrepreneurship and the expansion of local businesses are contributing to a higher demand for light commercial vehicles. Recent statistics indicate that SMEs account for a substantial portion of the overall market share in the light commercial truck segment. This trend is likely to continue, as more businesses seek to enhance their delivery capabilities and improve customer service. Consequently, manufacturers are focusing on developing versatile and affordable light commercial trucks tailored to the specific requirements of SMEs within the Light Commercial Truck Market.

Technological Integration and Connectivity

Technological integration is transforming the Light Commercial Truck Market, as advancements in connectivity and automation are reshaping vehicle capabilities. The incorporation of telematics systems allows fleet operators to monitor vehicle performance, optimize routes, and reduce operational costs. Furthermore, the rise of autonomous driving technology is expected to revolutionize logistics and transportation, potentially enhancing safety and efficiency. Data suggests that the adoption of connected vehicles could lead to a reduction in fuel consumption by up to 15%. As these technologies become more prevalent, they are likely to drive competition among manufacturers, pushing them to innovate and offer advanced features that cater to the evolving needs of businesses within the Light Commercial Truck Market.