North America : Market Leader in IP Services

North America continues to lead the Licensing and Intellectual Property Transactions Services Market, holding a significant market share of 12.0 in 2024. The region's growth is driven by robust demand for IP protection, increased innovation, and favorable regulatory frameworks. The presence of major corporations and a strong legal infrastructure further catalyze market expansion, making it a hub for IP transactions.

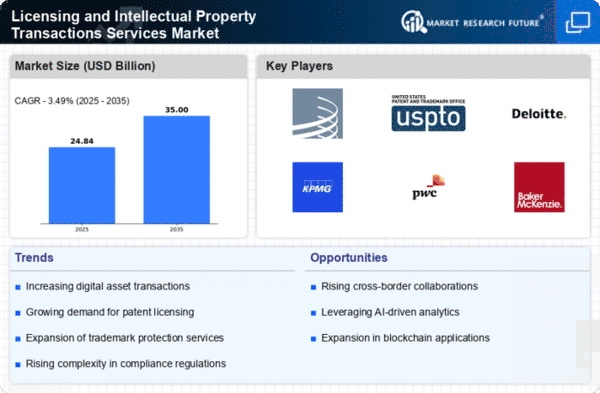

The competitive landscape is characterized by key players such as USPTO, Baker McKenzie, and Finnegan, which dominate the market. The United States, in particular, is a focal point for IP services, supported by a well-established legal system and a culture of innovation. This environment fosters collaboration between businesses and legal experts, ensuring effective management of intellectual property rights.

Europe : Growing Market with Diverse Needs

Europe's Licensing and Intellectual Property Transactions Services Market is valued at 6.0, reflecting a growing demand for IP services across various sectors. The region benefits from stringent IP regulations and a strong emphasis on innovation, which drive the need for effective licensing solutions. Countries like Germany and France are at the forefront, with increasing investments in technology and creative industries fueling market growth.

The competitive landscape features prominent players such as Deloitte and PwC, which offer comprehensive IP services. The European market is characterized by its diversity, with varying needs across member states. This complexity presents opportunities for tailored solutions, enhancing the region's attractiveness for IP transactions. "The European Union is committed to fostering innovation through robust IP protection mechanisms," European Commission report, European Commission.

Asia-Pacific : Emerging Powerhouse in IP Services

The Asia-Pacific region, with a market size of 4.5, is rapidly emerging as a powerhouse in the Licensing and Intellectual Property Transactions Services Market. The growth is driven by increasing economic development, a surge in technology adoption, and a growing awareness of IP rights among businesses. Countries like China and Japan are leading the charge, supported by government initiatives aimed at enhancing IP protection and enforcement.

The competitive landscape is evolving, with both local and international players vying for market share. Key firms such as KPMG and Latham & Watkins are expanding their presence in the region, catering to the rising demand for IP services. The region's dynamic market environment presents significant opportunities for innovation and collaboration, making it a focal point for IP transactions.

Middle East and Africa : Untapped Potential in IP Services

The Middle East and Africa region, with a market size of 1.5, presents untapped potential in the Licensing and Intellectual Property Transactions Services Market. The growth is driven by increasing awareness of IP rights and the need for legal frameworks to support innovation. Countries like South Africa and the UAE are making strides in establishing robust IP regulations, which are essential for attracting foreign investment and fostering local innovation.

The competitive landscape is still developing, with a mix of local firms and international players beginning to establish a foothold. The presence of organizations like WIPO is crucial in promoting IP education and awareness in the region. As the market matures, opportunities for growth and collaboration will expand, making it an attractive destination for IP services.