North America : Market Leader in IP Consulting

North America continues to lead the Intellectual Property (IP) Consulting Services market, holding a significant share of 7.5 in 2024. The region's growth is driven by a robust legal framework, increasing innovation, and a strong emphasis on protecting intellectual assets. Regulatory support and a high demand for IP services from technology and pharmaceutical sectors further catalyze this growth.

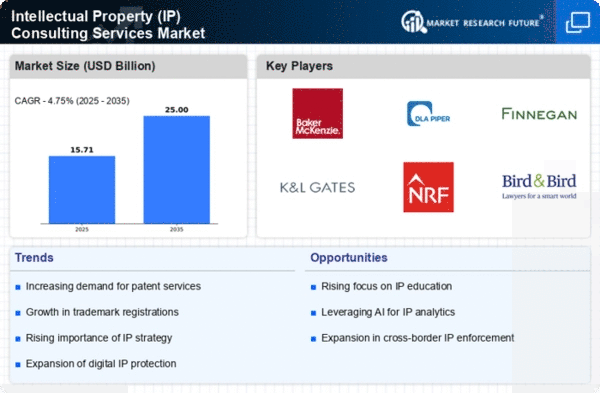

The United States is the primary player in this market, with key firms like Baker McKenzie, Finnegan, and Latham & Watkins dominating the landscape. The competitive environment is characterized by a mix of established firms and emerging players, all vying for a share of the lucrative market. The presence of major corporations seeking IP protection fuels demand, ensuring North America's continued leadership in this sector.

Europe : Growing Hub for IP Services

Europe's Intellectual Property (IP) Consulting Services market is on the rise, with a market size of 4.0 in 2024. The region benefits from harmonized regulations and a strong focus on innovation, particularly in technology and creative industries. The European Union's initiatives to strengthen IP rights and combat counterfeiting are key drivers of this growth, fostering a favorable environment for consulting services.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with firms like DLA Piper and Bird & Bird playing significant roles. The competitive landscape is marked by a blend of local and international firms, all striving to meet the increasing demand for IP protection and consulting. The emphasis on digital transformation and sustainability further enhances the market's potential.

Asia-Pacific : Emerging Market for IP Consulting

The Asia-Pacific region is witnessing a burgeoning demand for Intellectual Property (IP) Consulting Services, with a market size of 2.5 in 2024. Rapid economic growth, increasing innovation, and a rising number of startups are driving this trend. Countries are enhancing their IP frameworks to attract foreign investment, making the region a hotspot for consulting services in IP protection and management.

China, Japan, and Australia are leading the charge in this market, with a growing presence of both local and international consulting firms. The competitive landscape is evolving, with firms adapting to the unique challenges of the region, such as varying regulatory environments and cultural differences. The increasing focus on technology and digital rights is expected to further propel market growth in the coming years.

Middle East and Africa : Developing IP Consulting Landscape

The Middle East and Africa (MEA) region is gradually developing its Intellectual Property (IP) Consulting Services market, currently valued at 1.0 in 2024. The growth is driven by increasing awareness of IP rights and the need for businesses to protect their innovations. Governments are implementing policies to enhance IP frameworks, which is crucial for attracting foreign investment and fostering local entrepreneurship.

Countries like South Africa and the UAE are leading the way in establishing robust IP consulting services. The competitive landscape is characterized by a mix of local firms and international players, all aiming to capitalize on the growing demand for IP protection. As the region continues to evolve, the focus on technology and innovation will likely drive further growth in the IP consulting sector.