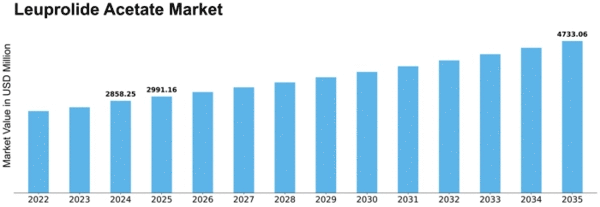

Leuprolide Acetate Size

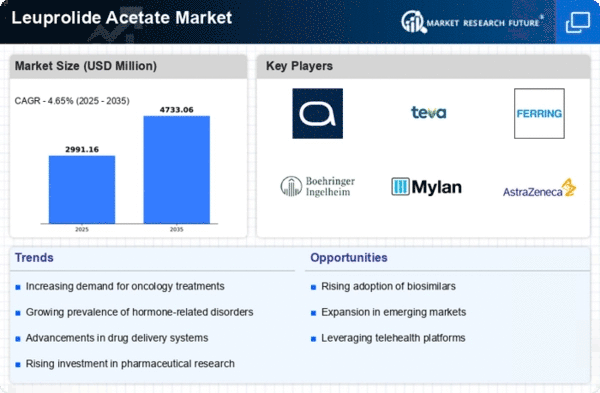

Leuprolide Acetate Market Growth Projections and Opportunities

The Leuprolide Acetate market, a critical segment within the pharmaceutical industry, is influenced by a myriad of market factors that collectively shape its dynamics. One of the primary drivers is the increasing prevalence of hormonal disorders and certain types of cancers, for which Leuprolide Acetate is a widely prescribed treatment. As the global population ages and awareness about these conditions grows, the demand for Leuprolide Acetate is expected to rise, fostering market expansion.

Regulatory factors also play a pivotal role in shaping the Leuprolide Acetate market. Stringent regulations and approval processes imposed by health authorities worldwide impact the production, distribution, and marketing of this drug. Compliance with these regulations is crucial for market players to ensure product quality, safety, and efficacy. Changes in regulatory frameworks can have significant implications on market dynamics, influencing pricing strategies and market entry barriers.

The competitive landscape is another crucial market factor for Leuprolide Acetate. With several pharmaceutical companies engaged in the production of generic and branded versions of the drug, competition is intense. Patent expirations and the entry of generic alternatives contribute to market dynamics, affecting pricing and market share. Companies often invest in research and development to introduce innovative formulations or delivery methods to gain a competitive edge in the market.

Market factors are also influenced by technological advancements in drug delivery systems. Continuous efforts to enhance the efficacy and convenience of Leuprolide Acetate administration contribute to market growth. The introduction of novel formulations, such as sustained-release implants or injections, can significantly impact patient compliance and market adoption. Technological innovations not only improve the therapeutic profile of the drug but also provide market players with opportunities to differentiate their products.

Economic factors, including healthcare expenditure and reimbursement policies, are integral components influencing the Leuprolide Acetate market. The affordability of the drug and its accessibility to a broader patient population are critical considerations. Economic fluctuations, changes in healthcare policies, and reimbursement scenarios can impact market growth and shape the pricing strategies of pharmaceutical companies.

Moreover, the evolving understanding of disease pathology and treatment modalities contributes to market dynamics. Advances in medical research and clinical studies that highlight the efficacy of Leuprolide Acetate in various therapeutic applications can drive market expansion. Awareness campaigns, both by healthcare professionals and patient advocacy groups, also influence market factors by increasing the recognition of Leuprolide Acetate as a viable treatment option.

Geographical factors further contribute to the Leuprolide Acetate market's complexity. Variations in healthcare infrastructure, disease prevalence, and economic conditions across different regions influence market demand. Companies often tailor their marketing and distribution strategies to address regional disparities and capitalize on emerging opportunities.

Leave a Comment