North America : Market Leader in Legal Services

North America continues to lead the Legal Document Review Services market, holding a significant share of 2.6 in 2024. The region's growth is driven by increasing litigation, regulatory compliance demands, and the adoption of advanced technologies like AI and machine learning. The legal sector's focus on efficiency and cost-effectiveness further fuels demand for these services, making it a critical market for providers.

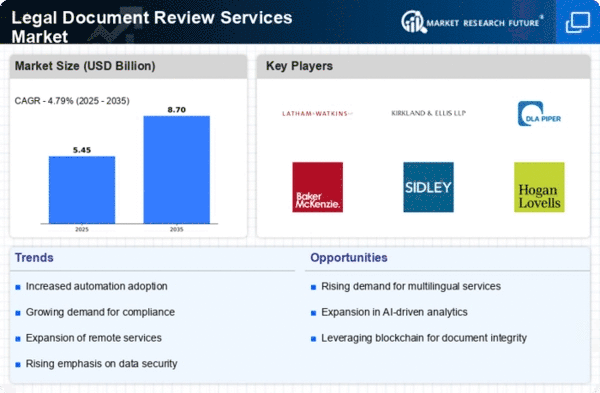

The competitive landscape is characterized by major players such as Latham & Watkins LLP, Kirkland & Ellis LLP, and DLA Piper, which dominate the market. The presence of these firms, along with a robust legal framework, enhances the region's attractiveness for legal document review services. As firms increasingly outsource these services, North America is poised for continued growth, solidifying its position as the market leader.

Europe : Emerging Market with Growth Potential

Europe's Legal Document Review Services market is valued at 1.5, reflecting a growing demand driven by complex regulatory environments and an increase in cross-border litigation. The region's growth is supported by stringent data protection laws and compliance requirements, which necessitate thorough document review processes. As businesses expand across borders, the need for legal services that can navigate these complexities is becoming increasingly vital.

Leading countries in this market include the UK, Germany, and France, where firms like Clifford Chance LLP and Linklaters LLP are prominent. The competitive landscape is evolving, with both established firms and new entrants vying for market share. The European market is characterized by a strong emphasis on compliance and regulatory adherence, making it a fertile ground for legal document review services.

Asia-Pacific : Rapidly Growing Legal Sector

The Asia-Pacific region, with a market size of 1.0, is witnessing rapid growth in Legal Document Review Services. This growth is fueled by increasing foreign investments, a rise in litigation, and the need for compliance with local regulations. Countries like China and India are leading this trend, as businesses seek to navigate complex legal landscapes. The adoption of technology in legal processes is also enhancing efficiency and accuracy in document reviews.

Key players in this region are beginning to emerge, with local firms gaining traction alongside international giants. The competitive landscape is becoming more dynamic, as firms adapt to the unique legal requirements of various countries. As the region continues to develop economically, the demand for legal document review services is expected to rise significantly, positioning Asia-Pacific as a key player in the global market.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region, with a market size of 0.1, represents an untapped potential for Legal Document Review Services. The growth in this region is driven by increasing foreign investments and a burgeoning legal framework that necessitates comprehensive document review processes. As businesses expand in these markets, the demand for legal services is expected to rise, particularly in sectors like oil and gas, finance, and telecommunications.

Countries such as South Africa and the UAE are at the forefront of this growth, with local firms beginning to establish themselves in the legal landscape. The competitive environment is still developing, but there is a clear opportunity for growth as more firms recognize the importance of legal compliance and efficient document management. The region's unique challenges present both opportunities and risks for service providers.