North America : Legal Services Powerhouse

North America continues to lead the Legal Advisory and Services Market, holding a significant market share of 150.0. The region's growth is driven by a robust economy, increasing corporate activities, and a complex regulatory environment that demands expert legal guidance. The demand for specialized legal services is on the rise, particularly in sectors like technology, healthcare, and finance, where compliance and litigation risks are paramount.

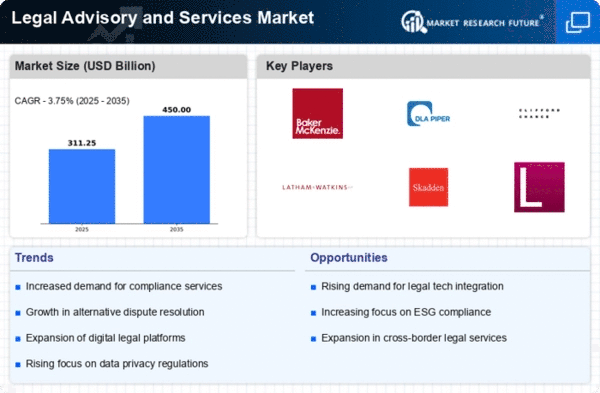

The competitive landscape is characterized by major players such as Baker McKenzie, DLA Piper, and Skadden, Arps, Slate, Meagher & Flom, which dominate the market. The U.S. remains the largest contributor, with a strong presence of international firms and a growing number of boutique legal practices. This dynamic environment fosters innovation and adaptability, ensuring that legal services evolve to meet the changing needs of clients.

Europe : Evolving Legal Landscape

Europe's Legal Advisory and Services Market is valued at 90.0, reflecting a diverse and evolving landscape. The region is experiencing growth driven by regulatory changes, increased cross-border transactions, and a heightened focus on compliance. Countries like Germany and the UK are at the forefront, with stringent regulations that necessitate expert legal advice, particularly in data protection and corporate governance.

The competitive environment features key players such as Clifford Chance and Linklaters, which are well-positioned to leverage their expertise in navigating complex legal frameworks. The presence of numerous multinational corporations further fuels demand for legal services, as businesses seek to mitigate risks associated with international operations. The market is expected to continue evolving, adapting to new challenges and opportunities.

Asia-Pacific : Emerging Legal Services Hub

The Asia-Pacific region, with a market size of 50.0, is rapidly emerging as a significant player in the Legal Advisory and Services Market. The growth is driven by increasing foreign investments, economic development, and a rising demand for legal services in sectors such as technology and real estate. Countries like China and India are witnessing a surge in legal requirements, particularly in areas like intellectual property and corporate law, as businesses expand their operations.

The competitive landscape is becoming increasingly dynamic, with both local firms and international players like Hogan Lovells and Sidley Austin establishing a strong presence. The region's legal market is characterized by a blend of traditional practices and innovative legal solutions, catering to the diverse needs of clients. As the market matures, the focus on quality and specialization is expected to intensify, driving further growth.

Middle East and Africa : Developing Legal Frameworks

The Middle East and Africa region, with a market size of 10.0, is witnessing gradual growth in the Legal Advisory and Services Market. This growth is primarily driven by economic diversification efforts, increased foreign investments, and the need for legal compliance in various sectors. Countries like the UAE and South Africa are leading the way, with evolving legal frameworks that require expert legal guidance, particularly in real estate and energy sectors.

The competitive landscape is characterized by a mix of local firms and international players, with a growing emphasis on specialized legal services. As the region continues to develop, the demand for legal advisory services is expected to rise, driven by both regulatory changes and the increasing complexity of business operations. The market presents opportunities for firms that can navigate the unique challenges of this diverse region.