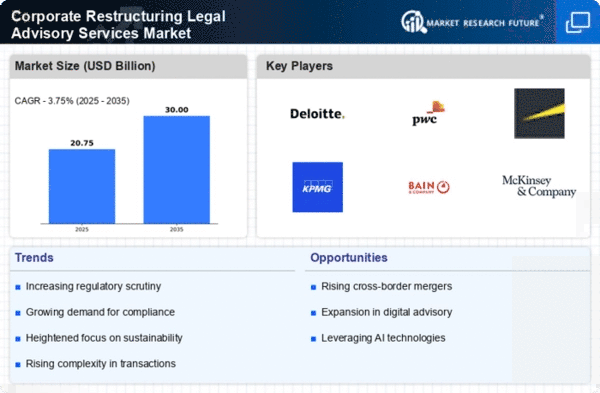

The Corporate Restructuring Legal Advisory Services Market is characterized by a dynamic competitive landscape, driven by the increasing complexity of global business operations and the need for strategic realignment. Key players such as Deloitte (GB), PwC (GB), and Alvarez & Marsal (US) are actively shaping the market through their innovative approaches and strategic initiatives. Deloitte (GB) has positioned itself as a leader in digital transformation, focusing on integrating advanced analytics into its advisory services. Meanwhile, PwC (GB) emphasizes a holistic approach to restructuring, combining legal, financial, and operational expertise to deliver comprehensive solutions. Alvarez & Marsal (US) has carved a niche in turnaround management, leveraging its deep industry knowledge to assist distressed companies in navigating complex restructuring processes. Collectively, these strategies contribute to a competitive environment that is increasingly focused on delivering value through innovation and tailored solutions.The market structure appears moderately fragmented, with a mix of large multinational firms and specialized boutique advisory services. Key players employ various business tactics, such as localizing their service offerings to meet regional demands and optimizing their operational frameworks to enhance efficiency. This competitive structure allows for a diverse range of services, catering to the unique needs of clients across different sectors. The influence of major firms is significant, as they set benchmarks for service quality and innovation, thereby shaping client expectations and industry standards.

In November Deloitte (GB) announced a strategic partnership with a leading technology firm to enhance its data analytics capabilities in restructuring advisory. This collaboration aims to leverage artificial intelligence (AI) to provide clients with predictive insights, thereby improving decision-making processes during restructuring. The strategic importance of this move lies in Deloitte's commitment to staying at the forefront of technological advancements, which is likely to enhance its competitive edge in the market.

In October PwC (GB) launched a new suite of digital tools designed to streamline the restructuring process for clients. This initiative reflects PwC's focus on integrating technology into its service offerings, enabling more efficient project management and real-time collaboration. The significance of this development is underscored by the growing demand for digital solutions in the advisory space, positioning PwC as a forward-thinking leader in the market.

In September Alvarez & Marsal (US) expanded its global footprint by opening new offices in key financial hubs across Asia. This expansion is indicative of the firm's strategy to tap into emerging markets and provide localized support to clients facing restructuring challenges. The strategic importance of this move lies in the potential to capture new business opportunities in regions that are experiencing rapid economic growth, thereby enhancing Alvarez & Marsal's market presence.

As of December the Corporate Restructuring Legal Advisory Services Market is witnessing trends that emphasize digitalization, sustainability, and AI integration. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and enhancing service delivery. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming more pronounced. In this evolving environment, firms that prioritize innovation and adaptability are likely to differentiate themselves and thrive in the competitive arena.