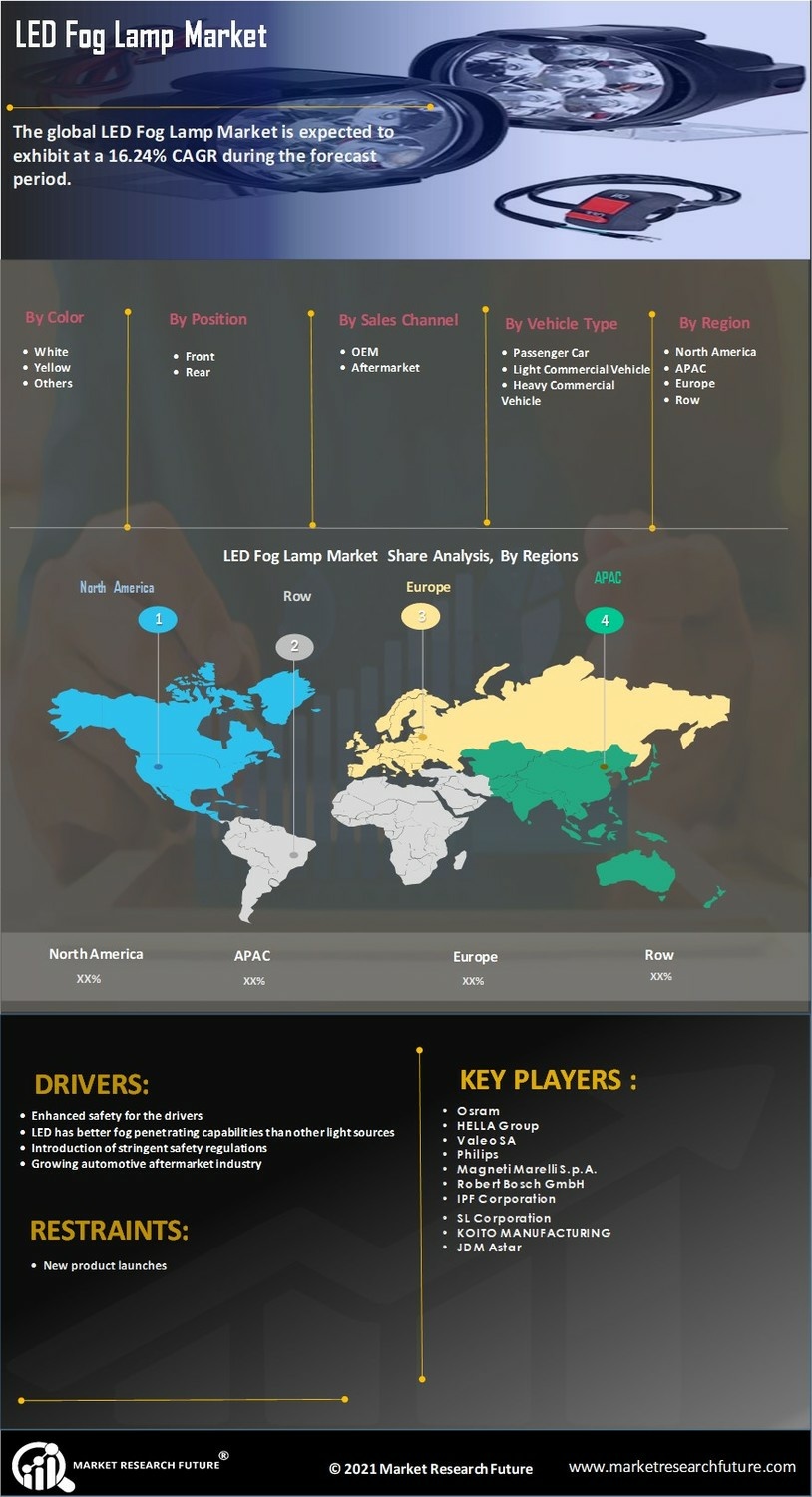

Rising Demand for Enhanced Visibility

The Global LED Fog Lamp Market Industry experiences a notable surge in demand driven by the increasing need for enhanced visibility during adverse weather conditions. As fog, rain, and snow can significantly impair driving visibility, the adoption of LED fog lamps is becoming more prevalent among consumers and automotive manufacturers alike. The market is projected to reach 1250 USD Million in 2024, reflecting a growing awareness of safety features in vehicles. This trend is particularly evident in regions with frequent inclement weather, where the installation of LED fog lamps is viewed as a critical safety enhancement.

Government Regulations and Safety Standards

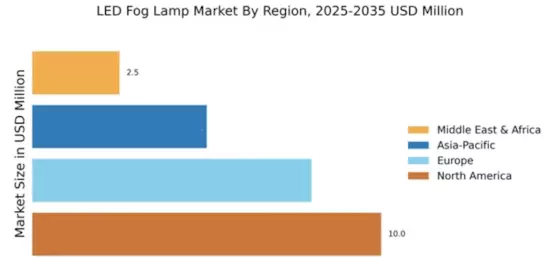

Government regulations and safety standards are increasingly influencing the Global LED Fog Lamp Market Industry. Many countries are implementing stringent regulations regarding vehicle safety, which often include requirements for enhanced lighting systems. These regulations encourage manufacturers to adopt LED fog lamps, which are recognized for their superior performance and energy efficiency. As a result, the market is likely to benefit from a growing emphasis on compliance with safety standards, further driving the adoption of LED fog lamps. This regulatory push is expected to contribute to a compound annual growth rate of 9.81% from 2025 to 2035.

Technological Advancements in Lighting Solutions

Technological advancements play a pivotal role in shaping the Global LED Fog Lamp Market Industry. Innovations in LED technology have led to the development of more efficient, durable, and brighter fog lamps, which are increasingly favored by consumers. These advancements not only improve visibility but also contribute to energy savings and longer product lifespans. As manufacturers continue to invest in research and development, the market is expected to grow significantly, with projections indicating a rise to 3500 USD Million by 2035. This growth is indicative of the industry's commitment to enhancing vehicle safety through superior lighting solutions.

Consumer Preference for Energy-Efficient Solutions

Consumer preference for energy-efficient solutions is a key factor driving the Global LED Fog Lamp Market Industry. As awareness of environmental issues grows, consumers are increasingly seeking products that reduce energy consumption and carbon footprints. LED fog lamps, known for their low power consumption and longevity, align well with these preferences. This shift towards energy-efficient lighting solutions is likely to enhance market growth, as more consumers opt for vehicles equipped with LED fog lamps. The market's trajectory suggests a robust increase, with expectations of reaching 1250 USD Million in 2024, reflecting the changing consumer landscape.

Growing Automotive Industry and Vehicle Production

The expansion of the automotive industry is a significant driver for the Global LED Fog Lamp Market Industry. As vehicle production increases globally, the demand for advanced lighting solutions, including LED fog lamps, is also on the rise. Manufacturers are integrating these lamps into new vehicle models to meet consumer preferences for safety and performance. This trend is particularly pronounced in emerging markets, where rising disposable incomes are leading to higher vehicle ownership rates. The anticipated growth in the automotive sector is expected to propel the market to new heights, aligning with the projected increase to 3500 USD Million by 2035.