Market Analysis

In-depth Analysis of LDL Test Market Industry Landscape

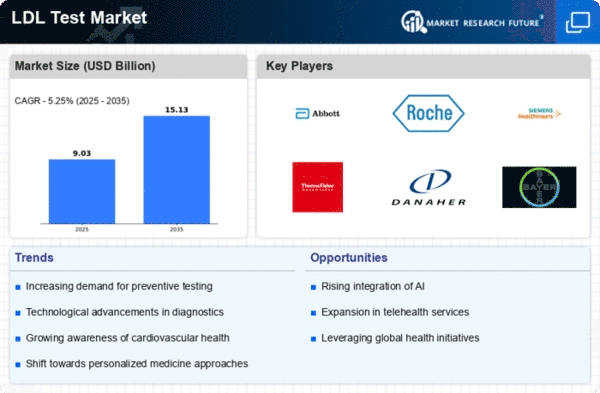

The market dynamics of the LDL test market are influenced by various factors that shape its growth and evolution. LDL, or low-density lipoprotein, testing plays a crucial role in assessing cardiovascular health by measuring levels of "bad" cholesterol in the blood. The demand for LDL testing is primarily driven by the growing prevalence of cardiovascular diseases, fueled by factors such as unhealthy diets, sedentary lifestyles, and aging populations. As cardiovascular diseases remain a leading cause of morbidity and mortality worldwide, there is a heightened awareness of the importance of cholesterol management, driving the demand for accurate and accessible LDL testing.

Additionally, advancements in healthcare infrastructure and diagnostic technologies are driving market growth. The availability of point-of-care testing devices and laboratory automation systems has facilitated the widespread adoption of LDL testing in various healthcare settings, including hospitals, clinics, and diagnostic laboratories. These technological advancements enable rapid test results, improve workflow efficiency, and enhance patient access to cholesterol screening, contributing to market expansion. Moreover, the integration of LDL testing into routine health screenings and preventive care programs further stimulates market demand by promoting early detection and intervention for cardiovascular risk factors.

Furthermore, market dynamics are influenced by regulatory frameworks, reimbursement policies, and healthcare expenditure. Regulatory approvals and quality standards govern the development, manufacturing, and marketing of LDL testing devices, ensuring their safety, efficacy, and accuracy. Reimbursement policies vary across different regions and healthcare systems, impacting patient access to LDL testing and reimbursement rates for healthcare providers. Markets with favorable reimbursement policies and healthcare coverage tend to experience higher adoption rates of LDL testing, while reimbursement constraints may hinder market growth in other regions.

Competitive forces also shape the dynamics of the LDL test market, with numerous companies competing for market share through product innovation, pricing strategies, and strategic partnerships. Established players leverage their brand reputation, technological expertise, and global distribution networks to maintain a competitive edge. They invest in research and development to introduce new LDL testing technologies, improve test accuracy, and enhance user experience. Moreover, strategic collaborations with healthcare providers, payers, and research institutions enable market players to expand their market presence, penetrate new geographic regions, and diversify their product portfolios.

The evolving landscape of personalized medicine and precision diagnostics is driving market dynamics, as healthcare providers increasingly emphasize targeted interventions based on individual patient characteristics and risk profiles. LDL testing plays a crucial role in personalized risk assessment and treatment planning for cardiovascular disease prevention. By integrating genetic, lifestyle, and clinical data, healthcare providers can tailor cholesterol management strategies to each patient's unique needs, optimizing treatment outcomes and reducing the burden of cardiovascular morbidity and mortality.

Despite the promising growth prospects, the LDL test market faces certain challenges and uncertainties that may impact its trajectory. Market saturation, pricing pressures, and reimbursement constraints pose challenges for market players, particularly smaller companies and new entrants. Moreover, concerns regarding test accuracy, standardization, and interpretation remain key considerations for healthcare providers, driving the need for continuous quality improvement and professional education. Additionally, emerging trends such as direct-to-consumer testing and digital health technologies present both opportunities and challenges for market players, requiring adaptation to changing consumer preferences and regulatory requirements.

Leave a Comment