North America : Market Leader in Innovation

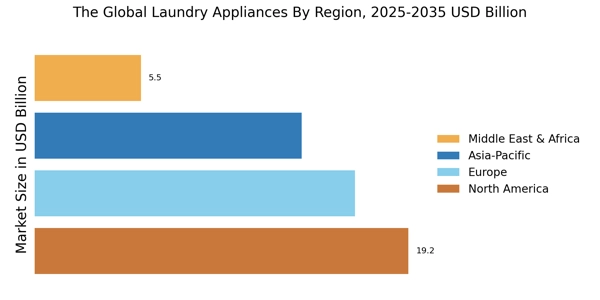

North America is the largest market for laundry appliances, holding approximately 35% of the global market share. Key growth drivers include rising disposable incomes, urbanization, and a growing preference for energy-efficient appliances. Regulatory catalysts, such as energy efficiency standards set by the U.S. Department of Energy, further stimulate market growth. The demand for smart appliances is also on the rise, driven by technological advancements and consumer preferences for convenience.

The competitive landscape in North America is dominated by major players like Whirlpool and GE Appliances, which are known for their innovative products and strong brand loyalty. Other significant competitors include LG Electronics and Samsung, which are expanding their market presence through advanced technology and sustainability initiatives. The region's focus on eco-friendly solutions is shaping product offerings, with manufacturers increasingly investing in research and development to meet consumer expectations.

Europe : Sustainability and Innovation Focus

Europe is the second-largest market for laundry appliances, accounting for around 30% of the global market share. The region's growth is driven by stringent environmental regulations and a strong consumer shift towards sustainable products. The European Union's Ecodesign Directive encourages manufacturers to develop energy-efficient appliances, which is a significant catalyst for market expansion. Additionally, the increasing urban population and changing lifestyles are contributing to the rising demand for advanced laundry solutions.

Leading countries in Europe include Germany, France, and the UK, with Germany being the largest market due to its robust manufacturing sector and high consumer demand for quality appliances. Key players such as Bosch and Miele are at the forefront, focusing on innovation and sustainability. The competitive landscape is characterized by a mix of established brands and emerging players, all striving to meet the evolving needs of environmentally conscious consumers.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the laundry appliances market, holding approximately 25% of the global market share. The region's growth is primarily driven by urbanization, increasing disposable incomes, and a growing middle class. Countries like China and India are leading this growth, with rising demand for modern appliances that offer convenience and efficiency. Government initiatives promoting energy-efficient appliances are also contributing to market expansion, as consumers become more environmentally conscious.

China is the largest market in the region, followed by India, where the demand for washing machines is surging due to changing lifestyles and increased awareness of hygiene. Key players such as Haier and LG Electronics are expanding their presence through innovative product offerings and competitive pricing strategies. The competitive landscape is evolving, with both local and international brands vying for market share, making it a dynamic environment for growth.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is emerging as a significant market for laundry appliances, holding about 10% of the global market share. The growth is driven by rapid urbanization, increasing disposable incomes, and a shift towards modern living standards. Countries like South Africa and the UAE are leading the market, with rising demand for energy-efficient and technologically advanced appliances. Government initiatives aimed at improving living standards are also contributing to market growth, as more consumers seek reliable laundry solutions.

In this region, the competitive landscape is characterized by a mix of local and international brands, with companies like Samsung and LG Electronics making significant inroads. The presence of key players is growing, as they adapt their offerings to meet the unique needs of consumers in diverse markets. The focus on affordability and energy efficiency is shaping product development, making this region a promising area for future growth.