Expansion of Industrial Applications

The Laser Processing Equipment Market is witnessing an expansion in its applications across various industrial sectors. Industries such as aerospace, medical, and construction are increasingly utilizing laser technologies for their unique capabilities. For instance, in the aerospace sector, lasers are used for precision cutting of lightweight materials, which is essential for aircraft manufacturing. The medical industry employs laser processing for applications such as surgical instruments and implants. This diversification of applications is likely to drive market growth, as more sectors recognize the benefits of laser processing. The increasing versatility of laser technologies suggests a promising outlook for the market.

Rising Demand from Automotive Sector

The automotive sector plays a pivotal role in driving the Laser Processing Equipment Market. With the increasing complexity of vehicle designs and the need for lightweight materials, manufacturers are turning to laser processing for precision cutting and welding. The market for laser processing equipment in the automotive industry is projected to grow at a compound annual growth rate of around 15% over the next few years. This growth is fueled by the need for enhanced safety features and fuel efficiency, which require advanced manufacturing techniques. As automotive manufacturers continue to innovate, the demand for laser processing equipment is expected to expand significantly.

Growing Adoption in Electronics Manufacturing

The electronics manufacturing sector is increasingly adopting laser processing technologies, which is a key driver for the Laser Processing Equipment Market. The need for miniaturization and precision in electronic components has led to a rise in the use of laser systems for tasks such as drilling, cutting tools, and marking. Recent statistics indicate that the electronics segment accounts for nearly 30% of the total laser processing equipment market. As consumer electronics continue to evolve, the demand for high-precision laser processing equipment is likely to increase, thereby supporting market growth. This trend suggests a robust future for laser technologies in the electronics sector.

Technological Advancements in Laser Technology

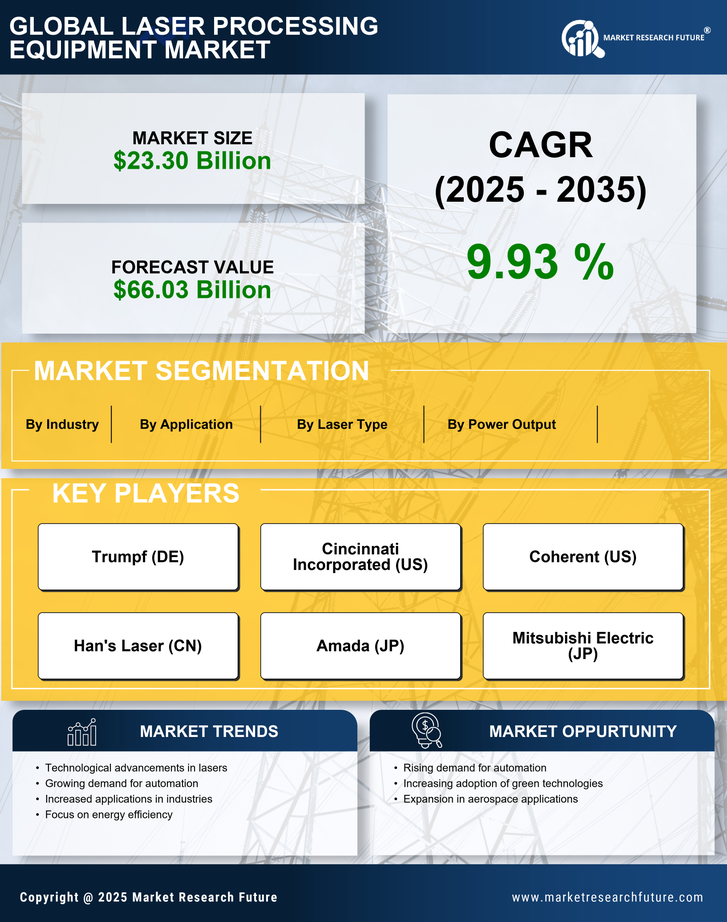

The Laser Processing Equipment Market is experiencing a surge in technological advancements, which enhances the efficiency and precision of laser systems. Innovations such as fiber lasers and ultrafast lasers are becoming increasingly prevalent, allowing for improved cutting, welding, and engraving capabilities. These advancements not only increase productivity but also reduce operational costs for manufacturers. According to recent data, the adoption of fiber lasers has grown by approximately 20% annually, indicating a strong trend towards more efficient laser solutions. As industries seek to optimize their processes, the demand for advanced laser processing equipment is likely to rise, further propelling the market forward.

Emphasis on Sustainable Manufacturing Practices

Sustainability is becoming a crucial focus within the Laser Processing Equipment Market. Manufacturers are increasingly seeking eco-friendly solutions that minimize waste and energy consumption. Laser processing technologies are inherently more efficient than traditional methods, often resulting in less material waste and lower energy usage. This shift towards sustainable practices is not only beneficial for the environment but also aligns with regulatory pressures and consumer preferences for greener products. As industries strive to meet sustainability goals, the demand for laser processing equipment that supports these initiatives is expected to rise, indicating a positive trend for the market.