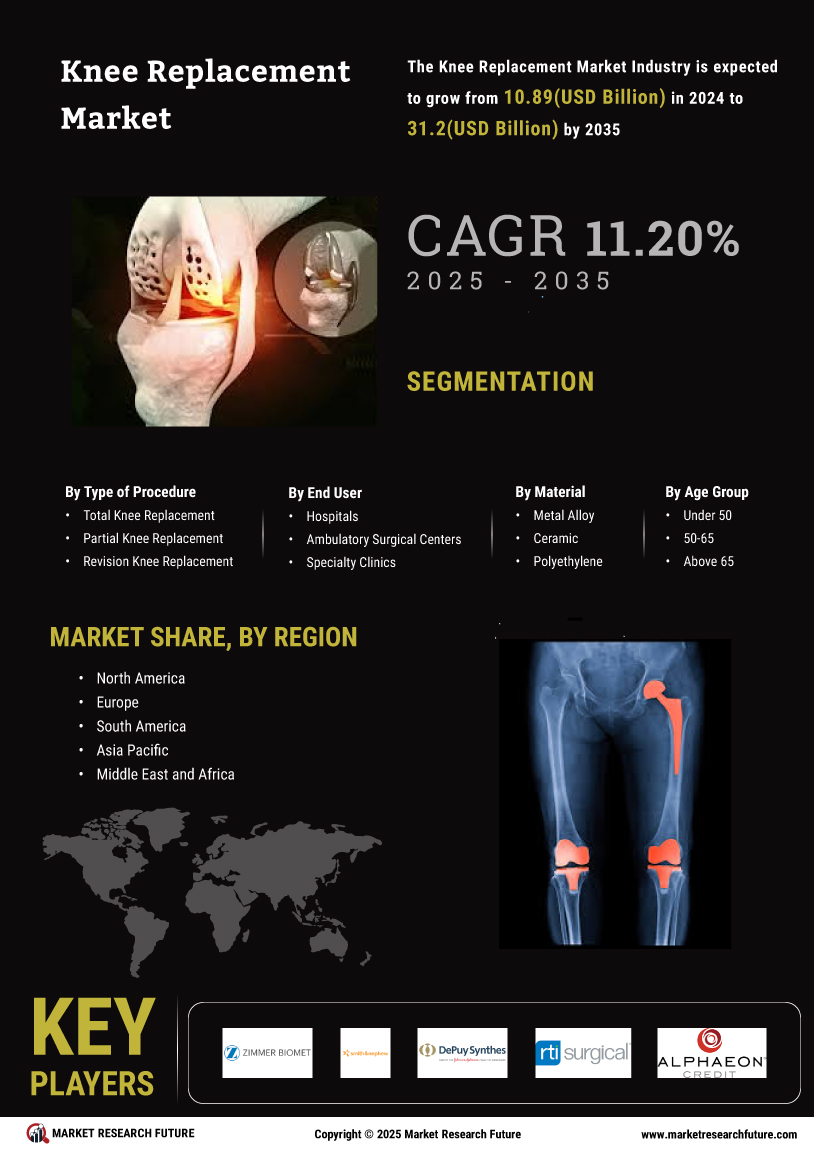

Growing Awareness and Education on Joint Health

The growing awareness and education regarding joint health are crucial drivers of the Knee Replacement Market. Public health campaigns and educational initiatives have increased knowledge about the benefits of early intervention for knee problems. As individuals become more informed about treatment options, they are more likely to seek medical advice and consider knee replacement surgeries as viable solutions. This heightened awareness is reflected in the rising number of consultations and procedures performed annually. Consequently, the Knee Replacement Market is expected to benefit from this trend, as more patients proactively address their joint health issues, leading to increased demand for surgical interventions.

Technological Innovations in Surgical Procedures

Technological advancements in surgical techniques and implant designs are significantly influencing the Knee Replacement Market. Innovations such as robotic-assisted surgeries and computer-assisted navigation systems enhance precision and reduce recovery times for patients. Data indicates that the adoption of robotic systems in knee surgeries has increased by over 20% in recent years, reflecting a shift towards more advanced surgical options. These technologies not only improve surgical outcomes but also attract a broader patient base seeking minimally invasive procedures. As healthcare providers continue to invest in cutting-edge technologies, the Knee Replacement Market is poised for growth, driven by the demand for improved surgical efficacy and patient satisfaction.

Rising Healthcare Expenditure and Insurance Coverage

The increase in healthcare expenditure and improved insurance coverage are pivotal factors driving the Knee Replacement Market. As countries allocate more resources to healthcare, patients are more likely to seek surgical interventions for knee issues. Recent statistics reveal that healthcare spending has risen significantly, with many nations investing in orthopedic care. Furthermore, the expansion of insurance coverage for knee replacement surgeries has made these procedures more accessible to a larger segment of the population. This trend suggests that as financial barriers diminish, the demand for knee replacements will likely surge, thereby contributing to the overall growth of the Knee Replacement Market.

Increase in Sports-Related Injuries and Active Lifestyles

The rise in sports-related injuries and the trend towards more active lifestyles are significant contributors to the Knee Replacement Market. As participation in sports and physical activities increases, so does the incidence of knee injuries, particularly among younger populations. Data suggests that sports injuries account for a substantial percentage of knee-related ailments, necessitating surgical interventions. This trend indicates that individuals are not only seeking knee replacements due to age-related issues but also as a result of active lifestyles that lead to injuries. As awareness of treatment options grows, the Knee Replacement Market is likely to expand, catering to a diverse demographic seeking solutions for knee injuries.

Aging Population and Increased Incidence of Osteoarthritis

The aging population is a primary driver of the Knee Replacement Market. As individuals age, the prevalence of osteoarthritis and other degenerative joint diseases tends to increase. According to recent data, nearly 27 million adults in the United States alone are affected by osteoarthritis, leading to a higher demand for knee replacement surgeries. This demographic shift suggests that healthcare systems will face mounting pressure to provide effective solutions for joint pain and mobility issues. Consequently, the Knee Replacement Market is likely to experience substantial growth as more individuals seek surgical interventions to improve their quality of life. The increasing incidence of knee-related ailments among older adults indicates a sustained demand for knee replacement procedures, thereby propelling market expansion.