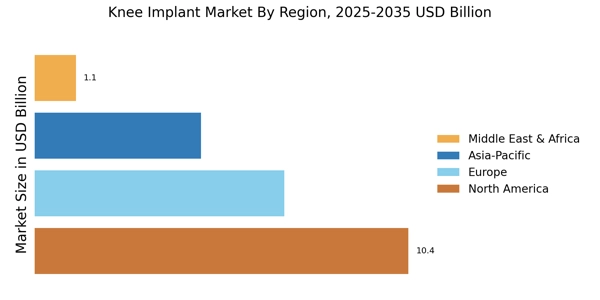

North America : Market Leader in Innovation

North America is the largest market for knee implants, accounting for approximately 45% of the global share. The region's growth is driven by an aging population, increasing prevalence of obesity, and advancements in surgical techniques. Regulatory support from agencies like the FDA has also catalyzed innovation in implant technologies, enhancing patient outcomes and safety. The demand for minimally invasive procedures is on the rise, further propelling market growth. The United States is the leading country in this region, with major players like Zimmer Biomet, Stryker, and DePuy Synthes dominating the landscape. The competitive environment is characterized by continuous innovation and strategic partnerships among key players. Canada also contributes significantly to the market, focusing on improving healthcare infrastructure and access to advanced knee implant solutions. Overall, the North American market remains robust and competitive, driven by technological advancements and a strong healthcare system.

Europe : Emerging Market with Growth Potential

Europe is the second-largest market for knee implants, holding approximately 30% of the global share. The region's growth is fueled by an increasing elderly population, rising awareness of joint health, and advancements in implant technology. Regulatory frameworks, such as the Medical Device Regulation (MDR), are enhancing product safety and efficacy, which is expected to boost market confidence and demand. Countries like Germany and France are leading the charge in adopting innovative knee implant solutions. Germany stands out as a key player in the European market, with a strong presence of companies like Ottobock and B. Braun. The competitive landscape is marked by a mix of established firms and emerging startups focusing on niche markets. France and the UK also contribute significantly, with ongoing investments in healthcare infrastructure and research. The European market is characterized by a focus on patient-centric solutions and a growing trend towards personalized medicine, which is expected to shape future developments in knee implants.

Asia-Pacific : Rapidly Growing Market Segment

Asia-Pacific is witnessing rapid growth in the knee implant market, accounting for approximately 20% of the global share. The region's expansion is driven by increasing healthcare expenditure, a rising geriatric population, and growing awareness of orthopedic health. Countries like China and India are experiencing a surge in demand for knee implants due to urbanization and improved access to healthcare services. Regulatory bodies are also working to streamline approval processes for new medical devices, further enhancing market growth. China is the largest market in the region, with significant contributions from local manufacturers and international players. The competitive landscape is evolving, with a mix of established companies and new entrants focusing on affordability and accessibility. India is also emerging as a key player, with increasing investments in healthcare infrastructure and a growing middle class seeking advanced medical solutions. The Asia-Pacific market is characterized by diverse needs and a focus on cost-effective solutions, making it a dynamic environment for knee implant manufacturers.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the knee implant market, holding about 5% of the global share. The growth is primarily driven by increasing healthcare investments, a rising prevalence of orthopedic conditions, and a growing awareness of advanced medical technologies. Countries like South Africa and the UAE are leading the market, with government initiatives aimed at improving healthcare infrastructure and access to quality medical services. Regulatory bodies are also working to enhance the approval processes for medical devices, which is expected to stimulate market growth. South Africa is the largest market in this region, with a growing number of healthcare facilities adopting advanced knee implant technologies. The competitive landscape is characterized by a mix of local and international players, focusing on affordability and accessibility. The UAE is also emerging as a key player, with significant investments in healthcare and a focus on attracting medical tourism. The Middle East and Africa market presents untapped opportunities for growth, driven by increasing demand for orthopedic solutions and improving healthcare systems.