Aging Population

The demographic shift towards an aging population is a critical driver for the Joint Reconstruction Device Market. As individuals age, the prevalence of degenerative joint diseases such as osteoarthritis increases, leading to a higher demand for joint reconstruction procedures. Data suggests that by 2030, the number of individuals aged 65 and older will reach approximately 1.5 billion, significantly impacting healthcare services. This growing demographic is likely to require more joint replacements, thereby propelling the market forward. Additionally, older patients often seek improved quality of life, which joint reconstruction devices can provide, further driving market growth as healthcare providers adapt to meet these needs.

Technological Advancements

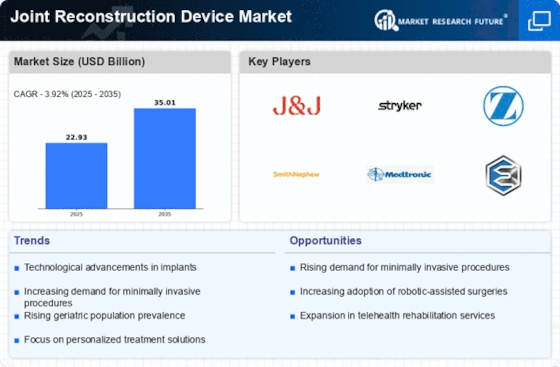

The Joint Reconstruction Device Market is experiencing a surge in technological advancements that enhance surgical outcomes and patient recovery. Innovations such as robotic-assisted surgery and 3D printing are revolutionizing the design and implementation of joint reconstruction devices. For instance, the integration of artificial intelligence in preoperative planning is streamlining procedures, potentially reducing operation times and improving precision. According to recent data, the market for robotic-assisted surgical systems is projected to grow significantly, indicating a shift towards more sophisticated surgical techniques. These advancements not only improve the efficacy of joint reconstruction but also contribute to lower complication rates, thereby increasing the overall appeal of these devices in the healthcare sector.

Minimally Invasive Techniques

Minimally invasive techniques are transforming the Joint Reconstruction Device Market by offering patients less traumatic surgical options. These techniques, which involve smaller incisions and reduced recovery times, are becoming increasingly popular among both surgeons and patients. The adoption of arthroscopic procedures has shown a marked increase, with studies indicating that patients experience less postoperative pain and quicker rehabilitation. Market data indicates that the minimally invasive segment is expected to grow at a compound annual growth rate of over 10% in the coming years. This trend not only enhances patient satisfaction but also encourages healthcare facilities to invest in advanced joint reconstruction technologies, thereby expanding the market.

Rising Healthcare Expenditure

Rising healthcare expenditure is a significant factor influencing the Joint Reconstruction Device Market. As countries allocate more resources to healthcare, there is an increased focus on orthopedic procedures, including joint reconstruction. This trend is particularly evident in regions where healthcare reforms are underway, leading to improved access to surgical interventions. Data indicates that healthcare spending is projected to rise by 5% annually, which could translate into higher investments in joint reconstruction technologies. Consequently, this influx of funding may facilitate research and development, resulting in innovative devices that cater to the evolving needs of patients and healthcare providers alike.

Increased Awareness and Education

Increased awareness and education regarding joint health are pivotal drivers for the Joint Reconstruction Device Market. As patients become more informed about joint diseases and available treatment options, the demand for joint reconstruction procedures is likely to rise. Educational campaigns and outreach programs by healthcare organizations are playing a crucial role in disseminating information about the benefits of joint reconstruction devices. Market Research Future indicates that patient awareness initiatives have led to a notable increase in elective surgeries, as individuals seek to improve their mobility and quality of life. This heightened awareness not only drives demand but also encourages healthcare providers to enhance their offerings in joint reconstruction.