Rising Incidence of Orthopedic Disorders

The increasing prevalence of orthopedic disorders, such as fractures and arthritis, is a primary driver for the Small Bone and Joint Device Market. As populations age, the incidence of these conditions tends to rise, leading to a greater demand for effective treatment solutions. According to recent data, the number of orthopedic surgeries performed annually has been steadily increasing, with projections indicating a growth rate of approximately 5% over the next few years. This trend underscores the necessity for innovative small bone and joint devices that can enhance patient outcomes and recovery times. Furthermore, the growing awareness of orthopedic health among the general population is likely to contribute to the demand for these devices, as individuals seek timely interventions for their conditions.

Technological Innovations in Device Design

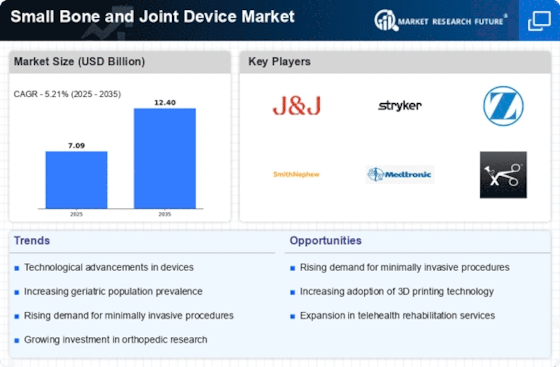

Technological advancements in the design and manufacturing of small bone and joint devices are significantly influencing the Small Bone and Joint Device Market. Innovations such as 3D printing and biocompatible materials are enabling the development of customized implants that cater to individual patient needs. This shift towards personalized medicine is expected to enhance surgical outcomes and reduce recovery times. Additionally, the integration of smart technologies, such as sensors and data analytics, into these devices is likely to provide real-time monitoring of patient progress, further driving market growth. The market is projected to witness a compound annual growth rate (CAGR) of around 6% as these technologies become more prevalent in orthopedic practices.

Increasing Demand for Minimally Invasive Surgeries

The growing preference for minimally invasive surgical techniques is a notable driver for the Small Bone and Joint Device Market. These procedures typically result in reduced postoperative pain, shorter hospital stays, and quicker recovery times, making them more appealing to both patients and healthcare providers. As surgical techniques evolve, the demand for specialized small bone and joint devices that facilitate these procedures is expected to rise. Market analysis suggests that the segment of minimally invasive devices could account for a substantial portion of the overall market, with an anticipated growth rate of 7% in the coming years. This trend reflects a broader shift towards patient-centered care in orthopedic surgery.

Rising Awareness and Education on Orthopedic Health

There is a growing awareness and education regarding orthopedic health, which serves as a vital driver for the Small Bone and Joint Device Market. Public health campaigns and educational initiatives are increasingly informing individuals about the importance of maintaining bone and joint health, as well as the available treatment options for various conditions. This heightened awareness is likely to lead to earlier diagnosis and treatment, thereby increasing the demand for small bone and joint devices. Furthermore, as healthcare professionals emphasize preventive care and proactive management of orthopedic issues, the market is expected to experience a surge in demand for innovative devices that address these needs.

Aging Population and Increased Healthcare Expenditure

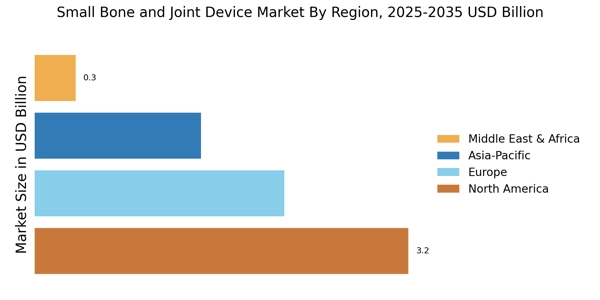

The aging population is a critical factor driving the Small Bone and Joint Device Market. As individuals age, they are more susceptible to conditions that necessitate orthopedic interventions, such as osteoporosis and degenerative joint diseases. This demographic shift is accompanied by increased healthcare expenditure, as governments and private sectors invest more in healthcare infrastructure and technologies. Reports indicate that healthcare spending is projected to rise significantly, with orthopedic devices being a key focus area. This increase in funding is likely to facilitate research and development in small bone and joint devices, ultimately leading to enhanced product offerings and improved patient care.