Government Support and Investment

The Japan virtual reality software market benefits significantly from government initiatives aimed at promoting technological innovation. The Japanese government has recognized the potential of VR technology in various sectors, including education, healthcare, and tourism. In 2025, the government allocated substantial funding to support research and development in VR applications, which is expected to foster innovation and enhance competitiveness. Additionally, policies encouraging collaboration between private companies and academic institutions are likely to accelerate the development of cutting-edge VR software. This supportive environment not only boosts the growth of the Japan virtual reality software market but also positions Japan as a leader in the global VR landscape.

Advancements in Hardware Technology

The Japan virtual reality software market is significantly influenced by advancements in hardware technology, which enhance the overall VR experience. Innovations in VR headsets, motion tracking, and haptic feedback systems are making virtual environments more realistic and accessible. In 2025, the introduction of lightweight and affordable VR headsets is expected to increase consumer adoption rates, particularly among casual users. Furthermore, improvements in graphics processing capabilities are likely to enable the development of more sophisticated VR applications. As hardware technology continues to evolve, it is anticipated that the Japan virtual reality software market will expand, attracting a broader audience and encouraging developers to create more diverse content.

Growing Interest in Virtual Tourism

The concept of virtual tourism is gaining traction within the Japan virtual reality software market, driven by the desire for unique travel experiences. As travel restrictions and environmental concerns persist, virtual tourism offers an alternative for individuals seeking to explore Japan's cultural heritage and natural beauty from the comfort of their homes. In 2025, the virtual tourism sector is projected to generate significant revenue, with numerous VR applications showcasing popular destinations such as Kyoto and Mount Fuji. This trend not only caters to domestic consumers but also attracts international audiences interested in experiencing Japan's rich culture. As the demand for virtual tourism grows, the Japan virtual reality software market is likely to benefit from increased investment and innovation.

Integration of VR in Corporate Training

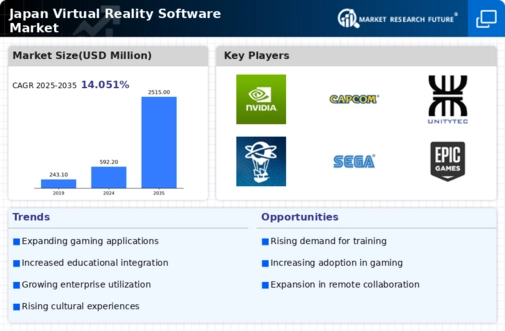

The adoption of virtual reality in corporate training programs is emerging as a significant driver for the Japan virtual reality software market. Companies are increasingly recognizing the benefits of VR for employee training, as it provides a safe and controlled environment for skill development. In 2025, it is estimated that over 40% of large corporations in Japan have implemented VR training solutions, leading to improved employee performance and reduced training costs. This trend is particularly evident in sectors such as manufacturing and healthcare, where hands-on training is crucial. As more organizations embrace VR technology for training purposes, the Japan virtual reality software market is likely to witness substantial growth.

Rising Demand for Immersive Entertainment

The Japan virtual reality software market is experiencing a notable surge in demand for immersive entertainment experiences. This trend is driven by the increasing popularity of VR gaming and virtual concerts, which have captivated a wide audience. In 2025, the revenue generated from VR gaming in Japan reached approximately 300 million USD, reflecting a robust growth trajectory. Major gaming companies are investing heavily in VR technology, leading to the development of innovative software that enhances user engagement. Furthermore, the integration of VR in theme parks and entertainment venues is likely to attract more visitors, thereby expanding the market. As consumer preferences shift towards more interactive and engaging forms of entertainment, the Japan virtual reality software market is poised for continued growth.