Emergence of Smart Technologies

The emergence of smart technologies is influencing the user entity-behavior-analytics market in Japan. With the proliferation of IoT devices and smart applications, businesses are presented with unprecedented opportunities to collect and analyze user data. This trend is reflected in a reported 30% increase in the deployment of IoT solutions among Japanese firms, which facilitates real-time data collection and analysis. As organizations harness the power of smart technologies, they can gain valuable insights into user behavior, preferences, and trends. This capability not only enhances operational efficiency but also enables businesses to create more personalized experiences for their customers. The user entity-behavior-analytics market is expected to thrive as companies increasingly adopt smart technologies to drive innovation and improve customer interactions.

Expansion of E-commerce Platforms

The expansion of e-commerce platforms is a significant driver for the user entity-behavior-analytics market in Japan. As online shopping continues to gain traction, businesses are increasingly relying on analytics to understand consumer behavior and optimize their digital strategies. Recent statistics indicate that e-commerce sales in Japan have grown by over 20% in the last year, prompting retailers to invest in analytics tools that provide insights into customer preferences and purchasing patterns. This growth in e-commerce not only necessitates a deeper understanding of user behavior but also encourages companies to enhance their online presence through targeted marketing efforts. As the e-commerce sector evolves, the user entity-behavior-analytics market is likely to benefit from increased investments aimed at improving customer engagement and driving sales.

Rising Demand for Personalization

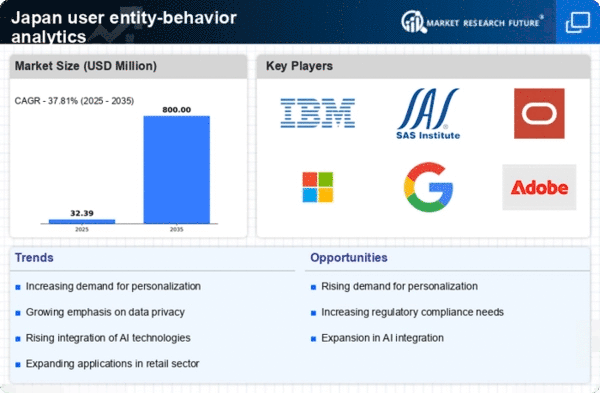

The user entity-behavior-analytics market in Japan is experiencing a notable surge in demand for personalized experiences. Businesses are increasingly leveraging analytics to tailor their offerings to individual preferences, thereby enhancing customer satisfaction. According to recent data, approximately 70% of consumers in Japan express a preference for personalized services, which drives companies to adopt advanced analytics solutions. This trend is particularly evident in sectors such as retail and e-commerce, where understanding consumer behavior is crucial for competitive advantage. As organizations strive to meet these expectations, the user entity-behavior-analytics market is likely to expand, with investments in technology and data analysis tools becoming a priority. The emphasis on personalization not only fosters customer loyalty but also contributes to higher conversion rates, indicating a robust growth trajectory for the market in the coming years.

Integration of Advanced Analytics Tools

The integration of advanced analytics tools is a pivotal driver for the user entity-behavior-analytics market in Japan. Organizations are increasingly adopting sophisticated technologies such as machine learning and predictive analytics to gain deeper insights into user behavior. This shift is evidenced by a reported 40% increase in the adoption of these tools among Japanese enterprises over the past year. By utilizing these technologies, businesses can analyze vast amounts of data to identify trends and patterns that inform strategic decision-making. The ability to predict customer behavior not only enhances operational efficiency but also allows for proactive engagement strategies. As companies recognize the value of data-driven insights, the user entity-behavior-analytics market is poised for significant growth, with a focus on integrating these advanced tools into existing systems.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming increasingly critical in the user entity-behavior-analytics market in Japan. With the introduction of stringent data protection laws, organizations are compelled to adopt robust analytics solutions that ensure compliance while maximizing data utility. Approximately 60% of Japanese companies report that regulatory requirements significantly influence their analytics strategies. This trend necessitates the implementation of comprehensive data governance frameworks that not only protect consumer information but also enhance trust. As businesses navigate the complexities of compliance, the demand for user entity-behavior-analytics solutions that prioritize data security and ethical usage is likely to rise. Consequently, this driver is expected to shape the market landscape, pushing companies to invest in technologies that align with regulatory standards.