Japan Textile Chemicals Market Summary

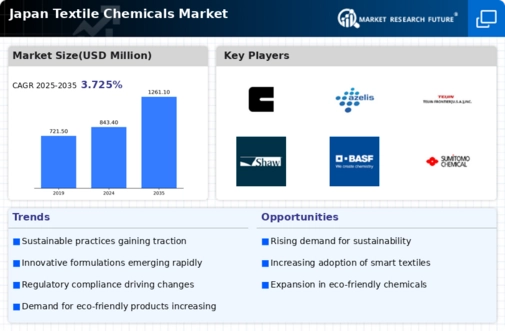

As per Market Research Future analysis, the Japan Textile Chemicals Market Size was estimated at 1309.14 $ Million in 2024. The Japan Textile Chemicals Market is projected to grow from 1355.75 $ Million in 2025 to 1923.0 $ Million by 2035, exhibiting a compound annual growth rate (CAGR) of 3.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Japan textile chemicals market is experiencing a shift towards sustainability and innovation.

- Sustainability initiatives are increasingly shaping the direction of the textile chemicals market in Japan.

- Technological advancements are driving efficiency and performance in textile processing, particularly in the largest segment of apparel.

- Customization and specialization are becoming essential as brands seek to differentiate their products in a competitive landscape.

- Rising demand for eco-friendly products and regulatory compliance are key drivers propelling market growth in Japan.

Market Size & Forecast

| 2024 Market Size | 1309.14 (USD Million) |

| 2035 Market Size | 1923.0 (USD Million) |

| CAGR (2025 - 2035) | 3.56% |

Major Players

BASF (DE), Huntsman Corporation (US), Clariant (CH), Dystar (DE), Solvay (BE), Archroma (CH), Lanxess (DE), Kraton Corporation (US), Troy Corporation (US)