Increasing Export Opportunities

The textile chemicals market is poised to benefit from increasing export opportunities as GCC countries expand their manufacturing capabilities. The region is becoming a hub for textile production, with several countries investing in state-of-the-art facilities to cater to both domestic and international markets. The export of textiles and textile products from the GCC is projected to grow by 10% annually, creating a corresponding demand for textile chemicals. This growth is likely to encourage local manufacturers to enhance their production processes and invest in high-quality chemical inputs. As the textile chemicals market evolves, the focus on export-oriented growth will play a pivotal role in shaping its future.

Rising Demand for Functional Textiles

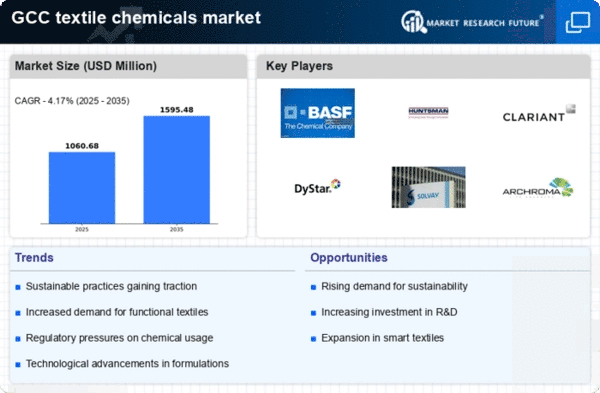

The textile chemicals market is experiencing a notable surge in demand for functional textiles, which are designed to provide specific benefits such as moisture management, UV protection, and antimicrobial properties. This trend is particularly pronounced in the GCC region, where the climate necessitates textiles that can withstand high temperatures and humidity. The market for functional textiles is projected to grow at a CAGR of approximately 7% from 2025 to 2030, indicating a robust opportunity for textile chemical manufacturers to innovate and cater to this demand. As consumers increasingly seek performance-oriented fabrics, the textile chemicals market is likely to expand, driven by the need for advanced chemical formulations that enhance textile functionality.

Growth of the Fashion and Apparel Sector

The textile chemicals market is significantly influenced by the growth of the fashion and apparel sector in the GCC. With a burgeoning population and rising disposable incomes, the demand for diverse clothing options is escalating. The fashion industry in the GCC is projected to reach a market value of $100 billion by 2025, which in turn drives the need for various textile chemicals used in dyeing, finishing, and printing processes. This growth presents a lucrative opportunity for chemical manufacturers to supply innovative solutions that meet the evolving needs of fashion brands. As the sector continues to expand, the textile chemicals market is expected to benefit from increased consumption of specialty chemicals that enhance the aesthetic and functional properties of textiles.

Regulatory Compliance and Safety Standards

The textile chemicals market is increasingly shaped by stringent regulatory compliance and safety standards imposed by governments in the GCC. These regulations aim to ensure that textile products are safe for consumers and environmentally friendly. As a result, manufacturers are compelled to adopt safer chemical alternatives and sustainable practices in their production processes. The market is witnessing a shift towards eco-friendly chemicals, which are projected to account for over 30% of the total textile chemicals market by 2026. This shift not only aligns with regulatory requirements but also caters to the growing consumer preference for sustainable products, thereby driving innovation and growth within the textile chemicals market.

Technological Innovations in Chemical Formulations

The textile chemicals market is benefiting from ongoing technological innovations in chemical formulations. Advances in nanotechnology and biotechnology are enabling the development of high-performance textile chemicals that offer enhanced durability, stain resistance, and colorfastness. These innovations are particularly relevant in the GCC, where the demand for high-quality textiles is on the rise. The market for advanced textile chemicals is expected to grow by approximately 5% annually, as manufacturers seek to differentiate their products through superior chemical properties. This trend suggests that investment in research and development will be crucial for companies aiming to maintain a competitive edge in the textile chemicals market.