Government Initiatives and Funding

Government initiatives play a crucial role in shaping the security system-integrators market in Japan. The government has been actively promoting public safety through various funding programs aimed at enhancing security infrastructure. In recent years, substantial investments have been allocated to upgrade surveillance systems in public spaces, transportation hubs, and critical infrastructure. For instance, the Japanese government has earmarked approximately ¥100 billion for security enhancements in urban areas by 2026. This financial support not only boosts the market but also encourages collaboration between public and private sectors, fostering innovation in security technologies. As a result, security system integrators are presented with opportunities to participate in large-scale projects, thereby expanding their market presence and capabilities.

Increased Awareness of Security Risks

The heightened awareness of security risks among businesses and individuals significantly influences the security system-integrators market in Japan. Recent studies indicate that approximately 70% of Japanese companies have reported concerns regarding potential security breaches and theft. This growing apprehension has led to a proactive approach in investing in security solutions. Organizations are increasingly recognizing the importance of safeguarding their assets, data, and personnel. Consequently, there is a marked shift towards comprehensive security systems that encompass surveillance, access control, and cybersecurity measures. This trend is likely to drive the demand for integrated solutions, compelling security system integrators to adapt their offerings to address these emerging concerns effectively.

Rising Demand for Advanced Security Solutions

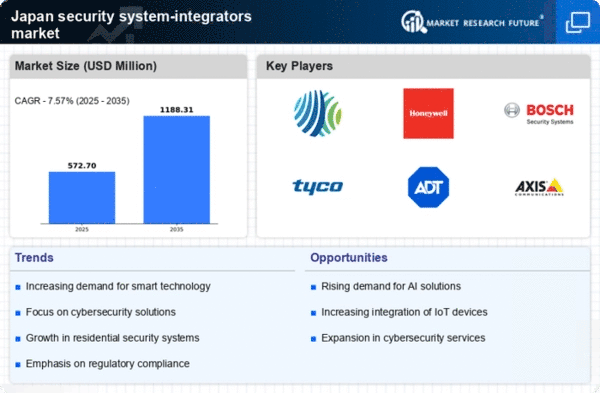

The security system-integrators market in Japan experiences a notable surge in demand for advanced security solutions. This trend is driven by increasing concerns over safety and security across various sectors, including residential, commercial, and industrial. As urbanization continues to rise, the need for sophisticated surveillance systems, access control, and alarm systems becomes paramount. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the urgency for enhanced security measures. The integration of cutting-edge technologies, such as AI and IoT, further propels this demand, as businesses and homeowners seek to protect their assets and ensure safety. Consequently, security system integrators are compelled to innovate and provide tailored solutions that meet the evolving needs of their clients.

Technological Advancements in Security Systems

Technological advancements are reshaping the landscape of the security system-integrators market in Japan. Innovations in video surveillance, biometric systems, and smart sensors are revolutionizing how security is managed. The introduction of AI-driven analytics and cloud-based solutions enhances the efficiency and effectiveness of security operations. In 2025, the market for smart security solutions is expected to account for over 40% of the total market share, indicating a significant shift towards technology-driven security measures. As these technologies become more accessible and affordable, security system integrators are likely to leverage them to provide enhanced services to their clients. This evolution not only improves security outcomes but also fosters a competitive environment among integrators to offer the latest solutions.

Growing Urbanization and Infrastructure Development

The rapid urbanization and infrastructure development in Japan are pivotal drivers of the security system-integrators market. As cities expand and new developments arise, the need for robust security systems becomes increasingly critical. Urban areas are witnessing a rise in population density, leading to heightened security concerns. In response, both public and private sectors are investing in comprehensive security solutions to protect infrastructure and ensure public safety. The construction of smart cities and integrated transport systems further necessitates advanced security measures. By 2025, it is anticipated that urban security spending will increase by approximately 15%, reflecting the urgent need for security system integrators to adapt to the evolving landscape and provide innovative solutions.