Growing Awareness of Security Risks

The heightened awareness of security risks among businesses and individuals in China is propelling the security system-integrators market forward. Recent surveys indicate that approximately 70% of companies are prioritizing security investments due to concerns over theft, data breaches, and vandalism. This shift in mindset is prompting organizations to seek comprehensive security solutions that integrate various technologies. As a result, security system integrators are expanding their service offerings to include risk assessments and tailored security plans. This trend not only enhances the market's growth potential but also encourages integrators to innovate and provide more effective solutions to meet diverse security needs.

Rising Demand for Smart Security Solutions

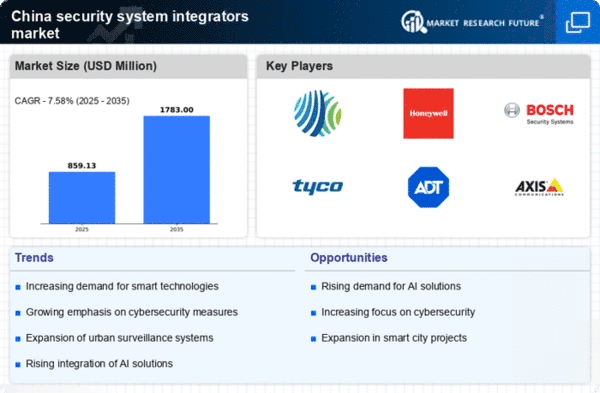

The security system-integrators market in China is experiencing a notable surge in demand for smart security solutions. This trend is driven by the increasing adoption of Internet of Things (IoT) devices, which are becoming integral to modern security systems. As urbanization accelerates, cities are investing heavily in smart infrastructure, leading to a projected market growth of approximately 15% annually. The integration of advanced technologies such as facial recognition and real-time monitoring is enhancing the effectiveness of security systems. Consequently, security system integrators are adapting their offerings to include these innovative solutions, thereby expanding their market reach and improving customer satisfaction.

Government Initiatives for Enhanced Public Safety

In China, government initiatives aimed at enhancing public safety are significantly influencing the security system-integrators market. The government has allocated substantial funding for the development of smart city projects, which include advanced surveillance and security systems. Reports indicate that public safety budgets have increased by over 20% in recent years, reflecting a commitment to improving urban security. This financial support encourages local authorities to collaborate with security system integrators to implement cutting-edge technologies. As a result, the market is likely to see a rise in partnerships between public entities and private integrators, fostering innovation and efficiency in security solutions.

Technological Advancements in Surveillance Systems

Technological advancements in surveillance systems are reshaping the security system-integrators market in China. Innovations such as high-definition cameras, cloud storage, and AI-driven analytics are becoming standard features in modern security solutions. The market for surveillance equipment is projected to grow by approximately 12% annually, driven by the demand for more sophisticated monitoring capabilities. As these technologies evolve, security system integrators are compelled to stay ahead of the curve by adopting the latest tools and techniques. This not only enhances their competitive edge but also ensures that clients receive state-of-the-art security solutions tailored to their specific requirements.

Increased Investment in Cybersecurity Infrastructure

The increasing investment in cybersecurity infrastructure is a critical driver for the security system-integrators market in China. With the rise of digital threats, organizations are recognizing the necessity of robust cybersecurity measures. Reports suggest that spending on cybersecurity solutions has surged by over 30% in recent years, as businesses seek to protect sensitive data and maintain operational integrity. This trend is prompting security system integrators to expand their expertise beyond physical security to include cybersecurity services. By offering comprehensive solutions that address both physical and digital security, integrators are positioning themselves as essential partners in safeguarding assets and information.