Government Initiatives and Support

The Japanese government plays a pivotal role in fostering the growth of the robot software market through various initiatives and support programs. With a focus on innovation and technological advancement, the government has allocated substantial funding to research and development in robotics. In 2025, public investment in robotics is projected to reach ¥200 billion, aimed at enhancing the capabilities of robotic systems. This support not only encourages domestic companies to develop cutting-edge software solutions but also attracts foreign investment. Consequently, the robot software market is likely to expand as new players enter the market, driven by favorable policies and financial backing.

Growing Interest in Service Robotics

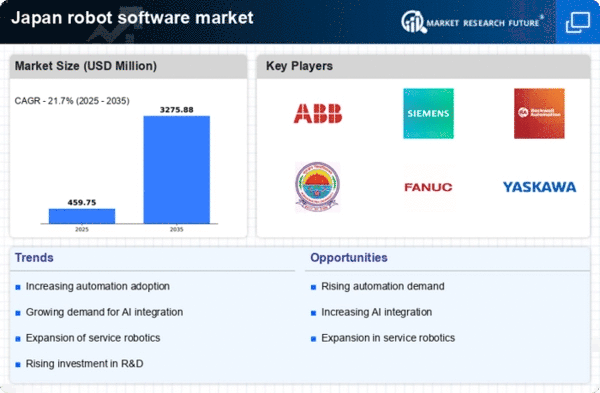

The robot software market in Japan is witnessing a growing interest in service robotics, which encompasses applications in hospitality, retail, and personal assistance. As consumer expectations evolve, businesses are increasingly turning to robotic solutions to enhance customer experiences. In 2025, the service robotics segment is expected to account for approximately 25% of the overall robot software market. This shift indicates a significant opportunity for software developers to create innovative applications tailored to service-oriented robots. The robot software market is thus likely to see a diversification of offerings, catering to the unique needs of various sectors.

Advancements in Machine Learning and AI

Advancements in machine learning and artificial intelligence are transforming the landscape of the robot software market in Japan. As these technologies evolve, they enable robots to perform complex tasks with greater autonomy and efficiency. In 2025, it is anticipated that AI-driven robotic systems will constitute around 40% of the total market share. This trend suggests a growing reliance on sophisticated algorithms and data analytics to enhance robotic capabilities. The robot software market stands to gain from this technological evolution, as companies seek to integrate AI solutions into their robotic systems to improve decision-making and operational efficiency.

Increased Focus on Safety and Compliance

Safety and compliance are becoming paramount considerations within the robot software market in Japan. As the deployment of robots in various sectors increases, so does the need for stringent safety standards and regulatory compliance. In 2025, it is projected that 70% of companies will prioritize safety features in their robotic systems. This focus not only ensures the protection of human workers but also enhances the overall reliability of robotic operations. The robot software market is likely to respond by developing software solutions that incorporate advanced safety protocols and compliance measures, thereby addressing the growing concerns of businesses and regulatory bodies.

Rising Demand for Automation in Manufacturing

The robot software market in Japan experiences a notable surge in demand driven by the increasing need for automation in manufacturing processes. As industries strive for enhanced efficiency and productivity, the integration of robotic systems becomes essential. In 2025, it is estimated that approximately 60% of manufacturing companies in Japan will adopt robotic solutions to streamline operations. This trend is particularly evident in sectors such as automotive and electronics, where precision and speed are paramount. The robot software market is poised to benefit significantly from this shift, as companies seek advanced software solutions to optimize robotic performance and reduce operational costs.