Rising Demand for Personalized Medicine

The pharmacy market in Japan is witnessing a shift towards personalized medicine, which tailors treatment to individual patient characteristics. This trend is largely driven by advancements in genomics and biotechnology, enabling pharmacists to offer customized therapies. As the population becomes more health-conscious, the demand for personalized medications is expected to rise significantly. Reports indicate that the personalized medicine segment could account for over 30% of the total pharmaceutical sales by 2027. This shift not only enhances treatment efficacy but also aligns with the growing emphasis on patient-centered care in the pharmacy market. Consequently, pharmacies are increasingly investing in training and resources to support this evolving landscape.

Increased Focus on Preventive Healthcare

Preventive healthcare is gaining momentum in Japan, significantly impacting the pharmacy market. With a growing awareness of health and wellness, consumers are increasingly seeking preventive solutions, such as vaccinations and health screenings, from pharmacies. This trend is reflected in the rising number of pharmacies offering immunization services, which has increased by approximately 20% in the last two years. Additionally, the government is promoting preventive health measures, which may further bolster pharmacy services. As a result, pharmacies are likely to expand their roles as health advisors, providing essential preventive care and contributing to the overall health of the population. This shift could lead to a more integrated approach within the pharmacy market.

Expansion of E-commerce in Pharmaceutical Sales

The rise of e-commerce is reshaping the pharmacy market in Japan, as consumers increasingly prefer the convenience of online shopping for medications and health products. The online pharmacy segment is projected to grow at a CAGR of around 7.5% through 2027, driven by factors such as improved logistics and consumer trust in online platforms. This shift is prompting traditional pharmacies to enhance their digital presence and offer online services, including home delivery and teleconsultations. As a result, the competitive landscape is evolving, with pharmacies needing to adapt to meet changing consumer preferences. This expansion of e-commerce is likely to redefine customer engagement strategies within the pharmacy market.

Technological Advancements in Pharmacy Services

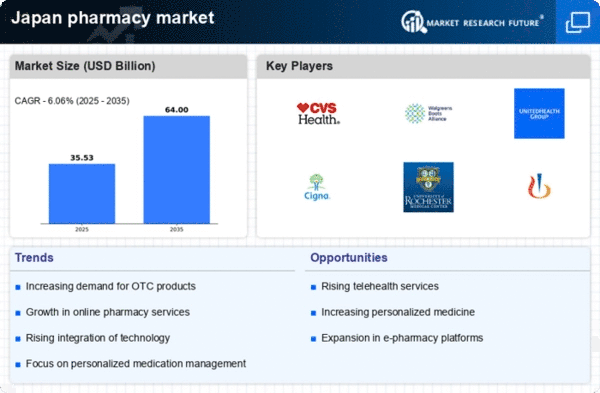

The pharmacy market in Japan is experiencing a notable transformation due to rapid technological advancements. Innovations such as automated dispensing systems and telepharmacy services are enhancing operational efficiency and patient care. The integration of artificial intelligence (AI) in medication management is also gaining traction, potentially reducing errors and improving adherence. As of 2025, the market is projected to grow at a CAGR of approximately 5.2%, driven by these technological improvements. Furthermore, the adoption of electronic health records (EHR) is streamlining communication between pharmacies and healthcare providers, thereby fostering a more cohesive healthcare ecosystem. This technological evolution is likely to redefine service delivery in the pharmacy market, making it more patient-centric and efficient.

Government Initiatives to Enhance Pharmacy Services

Government initiatives aimed at enhancing pharmacy services are playing a crucial role in shaping the pharmacy market in Japan. Policies promoting the integration of pharmacies into the healthcare system are encouraging pharmacies to expand their services beyond traditional dispensing. For instance, the government has introduced incentives for pharmacies to provide medication therapy management and chronic disease management services. These initiatives are expected to increase the value of pharmacy services, potentially leading to a market growth of approximately 4.8% annually. Furthermore, as the government emphasizes the importance of accessible healthcare, pharmacies are likely to become more integral to community health, thereby influencing the overall dynamics of the pharmacy market.