Expansion of the Biofuel Sector

The expansion of the biofuel sector is emerging as a significant driver for the Japan pectinase market. With Japan's commitment to reducing carbon emissions and promoting renewable energy sources, the demand for biofuels is on the rise. Pectinase is utilized in the production of bioethanol from agricultural residues, enhancing the efficiency of the fermentation process. As the government continues to support biofuel initiatives, the market for pectinase in this sector is expected to grow. In 2025, the biofuel market in Japan was valued at around 500 billion yen, indicating a substantial opportunity for pectinase applications. This trend suggests that the Japan pectinase market could experience increased investment and innovation in enzyme technologies.

Growing Food and Beverage Sector

The Japan pectinase market is experiencing growth driven by the expanding food and beverage sector. With a population that increasingly favors processed and convenience foods, the demand for pectinase, which aids in fruit juice extraction and improves texture, is on the rise. In 2025, the food and beverage industry in Japan was valued at approximately 20 trillion yen, indicating a robust market for pectinase applications. This growth is further supported by consumer preferences for natural and clean-label products, which pectinase can help achieve. As manufacturers seek to enhance product quality and yield, the utilization of pectinase in various food applications is likely to increase, thereby propelling the Japan pectinase market forward.

Rising Health Consciousness Among Consumers

Rising health consciousness among consumers is a pivotal driver for the Japan pectinase market. As individuals become more aware of the health benefits associated with natural ingredients, there is a growing preference for products that utilize pectinase to enhance nutritional value and digestibility. Pectinase plays a crucial role in the production of fruit juices and purees, which are perceived as healthier alternatives to sugary beverages. This trend is reflected in the increasing sales of organic and natural food products, which reached approximately 1.5 trillion yen in 2025. Consequently, the Japan pectinase market is likely to see heightened demand as manufacturers respond to consumer preferences for healthier options.

Technological Advancements in Enzyme Production

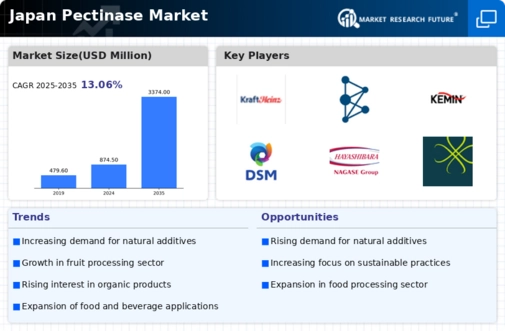

Technological advancements in enzyme production are significantly influencing the Japan pectinase market. Innovations in fermentation technology and enzyme extraction methods have led to more efficient and cost-effective production processes. For instance, the introduction of recombinant DNA technology has enabled the development of high-performance pectinases that cater to specific industrial needs. This has resulted in a broader range of applications, particularly in the food and beverage sector, where quality and efficiency are paramount. As companies invest in research and development to enhance enzyme efficacy, the Japan pectinase market is poised for substantial growth, with projections indicating a compound annual growth rate of around 5% over the next five years.

Regulatory Support for Biotechnological Products

The Japan pectinase market benefits from regulatory support for biotechnological products, which encourages the use of enzymes in various applications. The Japanese government has implemented policies that promote the use of enzymes in food processing, aligning with global trends towards sustainability and natural ingredients. This regulatory framework not only facilitates the approval process for new enzyme products but also provides incentives for companies to invest in enzyme research and development. As a result, the market for pectinase is likely to expand, with an increasing number of manufacturers entering the Japan pectinase market to capitalize on these favorable conditions.