Sustainability in Agriculture

Sustainability has emerged as a critical focus within the Germany pectinase market, particularly in agricultural practices. The use of pectinase in the processing of fruits and vegetables aligns with sustainable farming initiatives, as it enhances yield and reduces waste. By improving the extraction of juice and other products, pectinase contributes to more efficient resource utilization. Furthermore, the German government has implemented various policies aimed at promoting sustainable agriculture, which may further encourage the adoption of enzyme technologies. For instance, the Federal Ministry of Food and Agriculture has been actively supporting research and development in sustainable practices. This emphasis on sustainability is likely to drive the growth of the pectinase market, as producers seek to adopt environmentally friendly methods that resonate with both consumers and regulatory bodies.

Regulatory Support for Enzyme Use

The regulatory landscape surrounding enzyme use in Germany plays a pivotal role in shaping the pectinase market. The European Food Safety Authority (EFSA) has established guidelines that facilitate the safe use of enzymes in food processing. This regulatory support not only ensures consumer safety but also encourages manufacturers to incorporate pectinase into their production processes. As a result, the Germany pectinase market benefits from a clear framework that promotes innovation and the development of new enzyme applications. Moreover, the harmonization of regulations across the European Union simplifies market entry for new products, potentially expanding the market for pectinase. This supportive regulatory environment is likely to foster growth and investment in the pectinase sector, as companies seek to leverage the advantages offered by enzyme technologies.

Rising Demand for Natural Ingredients

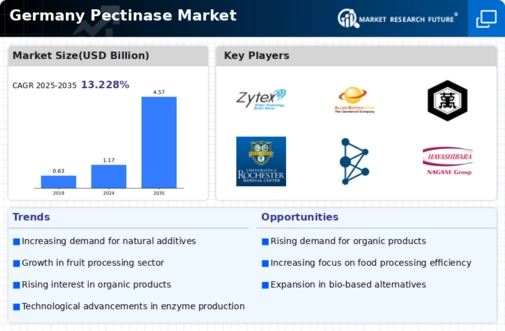

The Germany pectinase market is experiencing a notable surge in demand for natural ingredients, driven by consumer preferences for clean-label products. As consumers become increasingly health-conscious, they seek food and beverage options that are free from artificial additives. This trend is particularly evident in the fruit juice sector, where pectinase is utilized to enhance juice extraction and clarity. According to recent data, the natural food and beverage market in Germany is projected to grow at a compound annual growth rate (CAGR) of 5.2% through 2026. This growth is likely to bolster the demand for pectinase, as manufacturers strive to meet consumer expectations for transparency and quality in their products. Consequently, the rising demand for natural ingredients is a significant driver for the Germany pectinase market.

Technological Advancements in Enzyme Production

Technological advancements in enzyme production are significantly influencing the Germany pectinase market. Innovations in biotechnology have led to the development of more efficient and cost-effective methods for producing pectinase. For instance, the use of recombinant DNA technology has enabled the creation of enzyme variants with enhanced activity and stability. This not only improves the performance of pectinase in various applications but also reduces production costs, making it more accessible to manufacturers. As the demand for high-quality enzymes continues to rise, these technological advancements are likely to drive growth in the pectinase market. Furthermore, the integration of automation and process optimization in enzyme production facilities may enhance productivity, thereby supporting the expansion of the Germany pectinase market.

Growing Applications in Food and Beverage Sector

The food and beverage sector in Germany is witnessing a growing array of applications for pectinase, which serves as a key driver for the market. Pectinase is widely utilized in fruit juice production, wine clarification, and the processing of jams and jellies. The increasing popularity of fruit-based beverages and organic products is likely to further propel the demand for pectinase. Recent market analysis indicates that the fruit juice segment alone accounts for approximately 30% of the total enzyme market in Germany. As manufacturers seek to enhance product quality and consumer appeal, the versatility of pectinase in various food applications positions it as an essential ingredient. This trend underscores the importance of the food and beverage sector in driving the growth of the Germany pectinase market.