Increased Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, which positively impacts the orthopedic devices market. The government has been investing heavily in healthcare infrastructure and technology, with total healthcare spending reaching approximately $400 billion in recent years. This increase in funding allows for better access to advanced orthopedic devices, as hospitals and clinics can afford to purchase the latest technologies. Furthermore, the Japanese population's willingness to invest in health and wellness contributes to the demand for high-quality orthopedic solutions. As healthcare expenditure continues to grow, it is anticipated that the orthopedic devices market will benefit from enhanced availability and affordability of innovative products, thus fostering market expansion.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is significantly influencing the orthopedic devices market. Innovations such as 3D printing, robotics, and telemedicine are transforming the way orthopedic devices are designed, manufactured, and delivered. For instance, 3D printing allows for the customization of implants and prosthetics, catering to individual patient needs. In Japan, the adoption of robotic-assisted surgeries has increased, enhancing precision and reducing recovery times. This technological evolution not only improves patient outcomes but also drives the demand for new orthopedic devices. As these technologies become more prevalent, the orthopedic devices market is expected to witness substantial growth, with an estimated CAGR of 7% over the next few years.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the Japanese population, which is positively impacting the orthopedic devices market. Individuals are increasingly recognizing the importance of maintaining musculoskeletal health through preventive measures, such as the use of braces and supports. This shift in mindset is leading to a higher demand for orthopedic devices that can help prevent injuries and manage existing conditions. Educational campaigns and health initiatives by the government and healthcare organizations are further promoting this trend. As a result, the orthopedic devices market is likely to see an increase in sales, particularly in preventive products, as consumers prioritize proactive health management.

Expansion of E-commerce in Medical Devices

The expansion of e-commerce platforms in Japan is reshaping the orthopedic devices market. With the rise of online shopping, consumers are increasingly turning to digital channels to purchase medical devices. This trend is particularly evident among younger demographics who prefer the convenience of online shopping. E-commerce platforms provide access to a wider range of orthopedic devices, often at competitive prices. Additionally, the ability to compare products and read reviews enhances consumer confidence in purchasing decisions. As e-commerce continues to grow, it is expected that the orthopedic devices market will benefit from increased accessibility and sales, potentially leading to a market growth rate of around 5% in the coming years.

Rising Incidence of Musculoskeletal Disorders

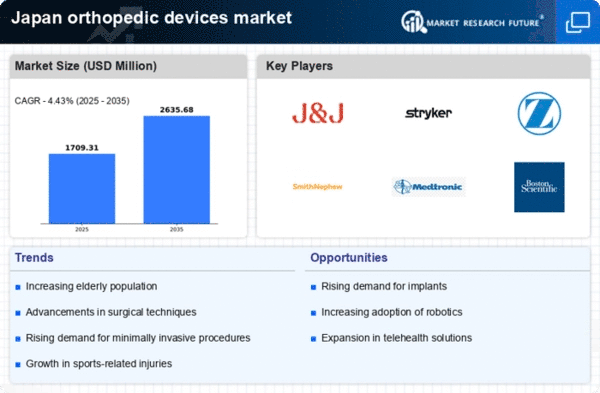

The orthopedic devices market in Japan is experiencing growth due to the increasing prevalence of musculoskeletal disorders. Conditions such as osteoarthritis and rheumatoid arthritis are becoming more common, particularly among the aging population. According to recent data, approximately 30% of adults aged 65 and older in Japan suffer from some form of arthritis. This rising incidence necessitates the demand for orthopedic devices, including joint replacements and braces. As the population ages, the orthopedic devices market is likely to expand, with projections indicating a compound annual growth rate (CAGR) of around 6% over the next five years. This trend underscores the critical need for effective treatment options and innovative devices to manage these conditions, thereby driving market growth.