Growth in Automotive Sector

The automotive sector in Japan significantly influences the lead acid-battery market, as these batteries are widely used in vehicles for starting, lighting, and ignition (SLI) applications. With Japan being home to major automotive manufacturers, the demand for lead acid batteries is expected to remain robust. In 2025, the automotive industry is projected to grow by 10%, which will likely drive the lead acid-battery market as well. Additionally, the increasing production of electric vehicles (EVs) may further stimulate the need for lead acid batteries in hybrid models, thereby enhancing the overall market landscape.

Infrastructure Development Initiatives

Japan's ongoing infrastructure development initiatives are contributing positively to the lead acid-battery market. The government has been investing heavily in transportation and energy infrastructure, which necessitates reliable power sources. Lead acid batteries are often utilized in various applications, including backup power systems for critical infrastructure. In 2025, the infrastructure sector is anticipated to grow by 8%, creating a favorable environment for the lead acid-battery market. This growth is indicative of the increasing need for dependable energy solutions in urban development projects, thereby enhancing the market's prospects.

Rising Demand for Renewable Energy Storage

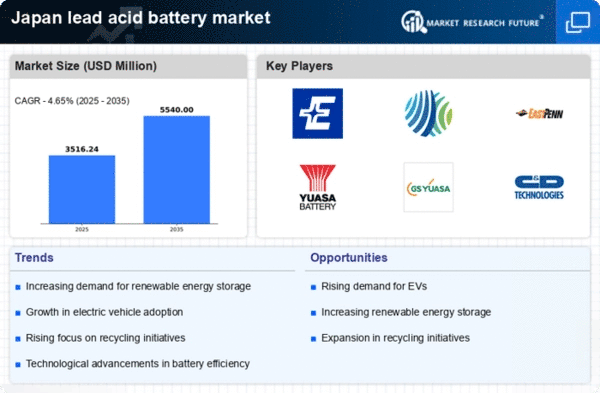

The lead acid battery market in Japan is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources. As Japan aims to enhance its energy security and reduce carbon emissions, the integration of solar and wind energy systems has become more prevalent. Lead acid batteries serve as a reliable storage solution, enabling the effective management of energy supply and demand. In 2025, the market for energy storage systems is projected to grow by approximately 15%, with lead acid batteries playing a crucial role in this transition. This trend indicates a shift towards sustainable energy practices, thereby bolstering the lead acid-battery market.

Increased Focus on Recycling and Circular Economy

The lead acid battery market in Japan is witnessing a shift towards recycling and the circular economy. With the growing awareness of environmental sustainability, there is a concerted effort to recycle lead acid batteries effectively. Japan has established robust recycling programs, which not only mitigate environmental impact but also reduce the need for raw material extraction. In 2025, it is estimated that the recycling rate for lead acid batteries could reach 95%, thereby supporting the market's growth. This focus on sustainability is likely to enhance the reputation of the lead acid-battery market, attracting more consumers and businesses.

Technological Innovations in Battery Manufacturing

Technological innovations in battery manufacturing are playing a pivotal role in shaping the lead acid battery market in Japan. Advances in production techniques and materials are enhancing the performance and lifespan of lead acid batteries. For instance, the introduction of advanced lead alloys and improved manufacturing processes has led to batteries that are more efficient and durable. In 2025, the market is expected to benefit from these innovations, with a projected increase in battery efficiency by 20%. This trend suggests that the lead acid-battery market will continue to evolve, meeting the demands of various industries more effectively.