Expansion of Smart Grid Technologies

The expansion of smart grid technologies in Japan is a crucial driver for the industrial ethernet market. As the country invests in modernizing its energy infrastructure, the need for reliable and efficient communication networks becomes paramount. Smart grids require robust industrial ethernet solutions to facilitate real-time monitoring and control of energy distribution. In 2025, the smart grid market is expected to grow by 25%, creating substantial opportunities for the industrial ethernet market. This growth is likely to encourage collaboration between energy providers and technology firms, further enhancing the adoption of industrial ethernet solutions in the energy sector.

Increased Focus on Energy Efficiency

The industrial ethernet market in Japan is witnessing a heightened focus on energy efficiency as companies aim to reduce operational costs and environmental impact. The push for sustainable practices is prompting industries to adopt energy-efficient networking solutions. In 2025, it is projected that the energy-efficient technology market will grow by 12%, influencing the industrial ethernet market positively. Companies are increasingly seeking solutions that not only enhance performance but also minimize energy consumption. This trend aligns with Japan's commitment to sustainability and could lead to a significant shift in how industrial ethernet solutions are designed and implemented.

Growing Need for Real-Time Data Processing

The industrial ethernet market in Japan is significantly driven by the growing need for real-time data processing across various industries. As businesses increasingly rely on data analytics for decision-making, the demand for high-speed, reliable networking solutions intensifies. In 2025, it is estimated that the market for real-time data processing technologies will expand by 18%, further propelling the industrial ethernet market. Industries such as manufacturing, logistics, and energy are particularly focused on implementing solutions that facilitate immediate data access and analysis. This trend underscores the critical role of industrial ethernet in enabling seamless communication and operational efficiency.

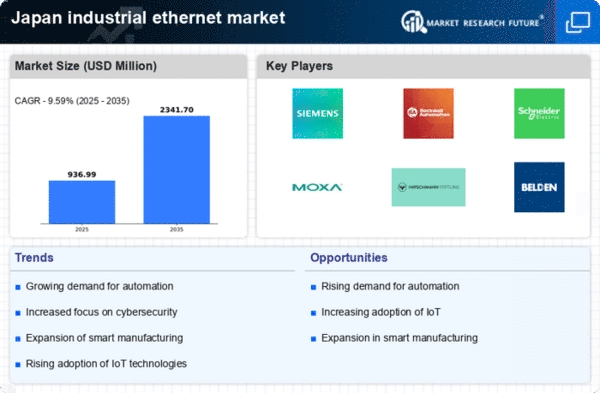

Rising Demand for Automation in Manufacturing

The industrial ethernet market in Japan experiences a notable surge in demand due to the increasing emphasis on automation within manufacturing processes. As industries strive for enhanced efficiency and productivity, the integration of industrial ethernet solutions becomes essential. In 2025, the automation sector is projected to grow by approximately 15%, driving the need for robust networking solutions. This trend is particularly evident in sectors such as automotive and electronics, where real-time data exchange and machine-to-machine communication are critical. The industrial ethernet market is thus positioned to benefit from this shift, as companies seek to implement advanced networking technologies to streamline operations and reduce downtime.

Government Initiatives Supporting Smart Manufacturing

Japanese government initiatives aimed at promoting smart manufacturing significantly influence the industrial ethernet market. With the 'Society 5.0' vision, the government encourages the adoption of advanced technologies, including industrial ethernet, to enhance productivity and innovation. Funding programs and incentives for companies investing in digital transformation are expected to increase the market's growth potential. In 2025, the government allocates approximately $1 billion to support these initiatives, which could lead to a 20% increase in the adoption of industrial ethernet solutions across various sectors. This proactive approach by the government fosters a conducive environment for the industrial ethernet market to thrive.