Rising Demand for Automation

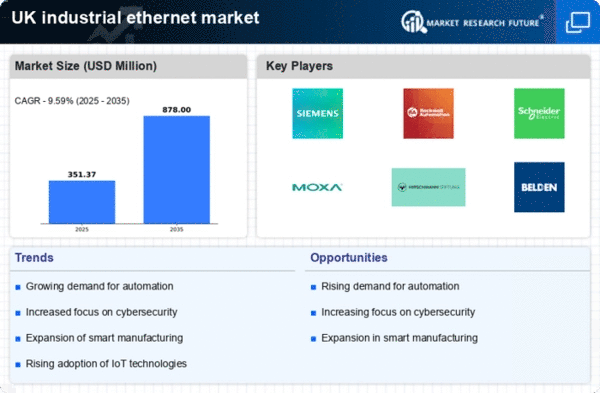

The industrial ethernet market in the UK is experiencing a notable surge in demand for automation technologies. This trend is driven by the need for enhanced operational efficiency and productivity across various sectors, including manufacturing and logistics. As companies strive to reduce operational costs and improve output, the integration of industrial ethernet solutions becomes increasingly vital. According to recent data, the automation sector is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust appetite for advanced networking solutions. This growth is likely to propel the industrial ethernet market, as businesses seek reliable and high-speed communication networks to support automated processes.

Expansion of Smart Manufacturing

The industrial ethernet market is significantly influenced by the expansion of smart manufacturing initiatives in the UK. As industries adopt advanced technologies such as artificial intelligence and machine learning, the need for robust and reliable communication networks becomes paramount. Smart manufacturing relies heavily on real-time data exchange, which is facilitated by industrial ethernet solutions. Recent statistics suggest that the smart manufacturing sector is expected to reach a valuation of £200 billion by 2026, highlighting the potential for growth in the industrial ethernet market. This shift towards interconnected systems necessitates the deployment of high-performance networking solutions to ensure seamless communication and data integrity.

Increased Focus on Data Analytics

The industrial ethernet market is witnessing a growing emphasis on data analytics. Businesses seek to leverage data for informed decision-making. The ability to collect and analyze vast amounts of data in real-time is becoming a competitive advantage for companies in various sectors. Industrial ethernet solutions play a crucial role in enabling this data-driven approach by providing the necessary infrastructure for high-speed data transmission. It is estimated that the data analytics market in the UK will grow by over 15% annually, further driving the demand for industrial ethernet technologies. This trend indicates a shift towards more intelligent operations, where data insights lead to improved efficiency and reduced downtime.

Integration of Industry 4.0 Technologies

The industrial ethernet market is being propelled by the integration of Industry 4.0 technologies within the UK. This paradigm shift towards interconnected systems and smart factories necessitates the adoption of advanced networking solutions that can support the seamless exchange of information. As industries embrace IoT devices and cloud computing, the demand for reliable and high-speed communication networks is expected to rise. Industry 4.0 is projected to contribute £455 billion to the UK economy by 2030, underscoring the potential for growth in the industrial ethernet market. The convergence of these technologies is likely to create new opportunities for networking solutions that can facilitate real-time data sharing and enhance operational efficiency.

Growing Need for Enhanced Security Protocols

The industrial ethernet market is increasingly shaped by the growing need for enhanced security protocols in the UK. As industries become more interconnected, the risk of cyber threats escalates. As industries become more interconnected, the risk of cyber threats escalates, prompting businesses to invest in robust security measures. Industrial ethernet solutions are evolving to incorporate advanced security features that protect sensitive data and ensure network integrity. Recent reports indicate that the cybersecurity market in the UK is expected to reach £8 billion by 2025, reflecting the urgency for secure networking solutions. This heightened focus on security is likely to drive the adoption of industrial ethernet technologies, as companies seek to safeguard their operations against potential cyber threats.