Growing Infrastructure Projects

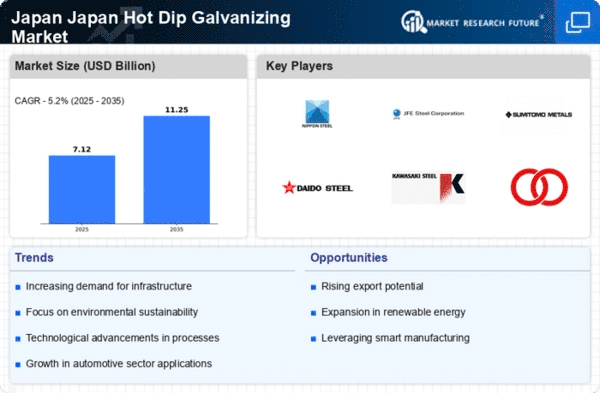

The Japan Hot Dip Galvanizing Market is benefiting from a surge in infrastructure projects across the country. The government has announced several initiatives aimed at revitalizing aging infrastructure, which includes roads, bridges, and railways. With an estimated investment of over 10 trillion yen in infrastructure development over the next decade, the demand for galvanized steel is expected to rise significantly. This trend is particularly evident in urban areas where modernization efforts are underway. As a result, hot dip galvanizing is becoming increasingly essential for ensuring the longevity and safety of these infrastructure projects.

Increased Focus on Sustainability

The Japan Hot Dip Galvanizing Market is witnessing a shift towards sustainability, driven by both consumer preferences and corporate responsibility. Companies are increasingly adopting environmentally friendly practices, including the use of hot dip galvanizing, which is known for its recyclability and low environmental impact. The Japanese government is also promoting green building initiatives, which encourage the use of sustainable materials in construction. This focus on sustainability is likely to enhance the market for hot dip galvanized products, as they align with the growing demand for eco-friendly solutions in various industries, including construction and manufacturing.

Government Regulations and Standards

The Japan Hot Dip Galvanizing Market is significantly influenced by stringent government regulations aimed at promoting environmental sustainability and safety. The Japanese government has implemented various standards that mandate the use of galvanized materials in public infrastructure projects. For instance, the Ministry of Land, Infrastructure, Transport and Tourism has set guidelines that encourage the use of hot dip galvanized steel in bridges and buildings to enhance durability and reduce maintenance costs. These regulations not only support the growth of the market but also ensure that the materials used are environmentally friendly, aligning with Japan's commitment to sustainable development.

Rising Demand for Corrosion Resistance

The Japan Hot Dip Galvanizing Market is experiencing a notable increase in demand for corrosion-resistant materials. This trend is largely driven by the construction and automotive sectors, where the longevity and durability of materials are paramount. In Japan, the construction industry is projected to grow at a rate of 3.5% annually, leading to a heightened need for galvanized steel. The automotive sector, which is increasingly focusing on lightweight and corrosion-resistant materials, is also contributing to this demand. As a result, manufacturers are investing in hot dip galvanizing processes to meet these requirements, thereby enhancing the overall market landscape.

Technological Innovations in Galvanizing Processes

Technological advancements are playing a crucial role in shaping the Japan Hot Dip Galvanizing Market. Innovations such as improved galvanizing techniques and automation in production processes are enhancing efficiency and reducing costs. For example, the introduction of advanced coating technologies has led to better adhesion and corrosion resistance, which are essential for various applications. Additionally, the integration of Industry 4.0 technologies, such as IoT and AI, is streamlining operations and improving quality control. These technological innovations not only boost productivity but also position Japanese manufacturers competitively in the global market.