Growing Automotive Sector

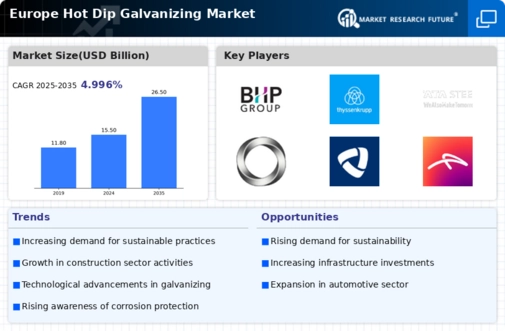

The automotive sector in Europe is experiencing a resurgence, which seems to be positively impacting the Europe Hot Dip Galvanizing Market. With the rise of electric vehicles and stringent emissions regulations, manufacturers are increasingly utilizing galvanized steel for vehicle components. The European automotive industry is expected to grow at a CAGR of approximately 3% from 2025 to 2030. This growth is likely to drive demand for hot dip galvanized products, as they offer enhanced durability and corrosion resistance, essential for automotive applications.

Technological Innovations

Technological innovations in the hot dip galvanizing process are contributing to the growth of the Europe Hot Dip Galvanizing Market. Advances in automation and quality control are enhancing the efficiency and effectiveness of galvanizing operations. For example, the introduction of advanced coating technologies is improving the adhesion and durability of galvanized products. As manufacturers adopt these innovations, the overall quality of hot dip galvanized products is expected to improve, potentially increasing their market share in various applications, including construction and automotive.

Infrastructure Development

The ongoing infrastructure development across Europe appears to be a significant driver for the Europe Hot Dip Galvanizing Market. Governments are investing heavily in transportation, energy, and urban development projects, which necessitate the use of durable materials. Hot dip galvanizing provides corrosion resistance, extending the lifespan of steel structures. For instance, the European Commission's investment plans for infrastructure projects are projected to reach over 1 trillion euros by 2027. This influx of funding is likely to increase the demand for galvanized steel in construction and infrastructure, thereby bolstering the market.

Regulatory Support and Standards

Regulatory support and the establishment of standards are playing a crucial role in shaping the Europe Hot Dip Galvanizing Market. The European Union has implemented various regulations aimed at promoting the use of galvanized steel in construction and infrastructure projects. Compliance with these regulations not only ensures safety but also encourages the adoption of hot dip galvanizing as a preferred method for corrosion protection. The alignment of industry standards with regulatory frameworks is likely to foster growth in the market, as more companies seek to meet these requirements.

Increased Focus on Sustainability

The heightened focus on sustainability within Europe is influencing the Europe Hot Dip Galvanizing Market. As industries strive to reduce their carbon footprint, hot dip galvanizing emerges as a preferred choice due to its recyclability and longevity. The European Union's Green Deal aims to make Europe climate-neutral by 2050, which may lead to increased investments in sustainable practices. This shift towards eco-friendly solutions is likely to enhance the demand for hot dip galvanized products, as they align with the sustainability goals of various sectors.