Emergence of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the high performance-computing-as-a-service market in Japan. Organizations are increasingly opting for cloud services to access scalable computing resources without the need for substantial upfront investments in hardware. This trend is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the capital to invest in traditional high-performance computing infrastructure. The flexibility and cost-effectiveness of cloud-based services are likely to drive market growth, as businesses seek to optimize their IT expenditures. As of now, cloud adoption in Japan is estimated to reach around 30% of total IT spending, indicating a robust potential for the high performance-computing-as-a-service market to thrive in this evolving landscape.

Government Initiatives and Funding

The Japanese government is actively promoting the adoption of high performance-computing-as-a-service solutions through various initiatives and funding programs. These efforts aim to bolster the country's technological infrastructure and enhance its competitiveness in the global market. For instance, the government has allocated substantial budgets to support research and development in supercomputing technologies. This financial backing is expected to stimulate growth in the high performance-computing-as-a-service market, as public and private sectors collaborate to develop innovative solutions. Furthermore, the government's commitment to fostering a digital economy is likely to create a conducive environment for the expansion of high performance-computing services, thereby attracting more investments and partnerships.

Focus on Cybersecurity and Data Privacy

As the high performance-computing-as-a-service market expands in Japan, the focus on cybersecurity and data privacy is becoming increasingly critical. Organizations are recognizing the importance of safeguarding sensitive data and ensuring compliance with stringent regulations. This heightened awareness is driving demand for high-performance computing solutions that incorporate robust security measures. Service providers are likely to invest in advanced security technologies to protect their infrastructures and client data. The emphasis on cybersecurity not only enhances trust among users but also positions the high performance-computing-as-a-service market as a reliable option for organizations concerned about data breaches and cyber threats.

Collaboration with Academic Institutions

Collaboration between the high performance-computing-as-a-service market and academic institutions in Japan is fostering innovation and research advancements. Universities and research centers are increasingly partnering with service providers to access high-performance computing resources for scientific research and technological development. This collaboration not only enhances the capabilities of academic institutions but also drives the demand for high performance-computing services. As research projects become more complex and data-driven, the need for powerful computing resources is expected to grow. The high performance-computing-as-a-service market is likely to benefit from these partnerships, as they create opportunities for knowledge exchange and the development of cutting-edge solutions.

Rising Demand for Data-Intensive Applications

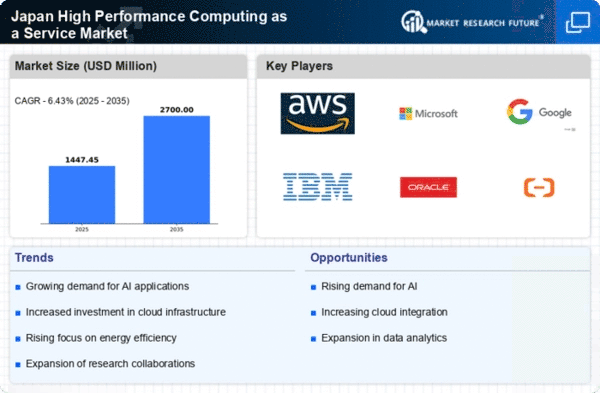

The high performance-computing-as-a-service market in Japan is experiencing a notable surge in demand driven by the increasing reliance on data-intensive applications across various sectors. Industries such as finance, healthcare, and manufacturing are leveraging advanced analytics and simulations that require substantial computational power. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is largely attributed to the need for real-time data processing and analysis, which is essential for making informed business decisions. As organizations seek to enhance their operational efficiency and innovation capabilities, the high performance-computing-as-a-service market is positioned to play a critical role in supporting these data-driven initiatives.