Increased Health Awareness

The frozen pizza market in Japan is influenced by an increase in health awareness among consumers. As individuals become more conscious of their dietary choices, there is a rising demand for healthier frozen pizza options. This includes products made with whole grain crusts, organic ingredients, and reduced sodium levels. In 2025, it is projected that health-oriented frozen pizzas will account for approximately 25% of total sales in the market. The frozen pizza market is adapting to this trend by reformulating existing products and introducing new lines that cater to health-conscious consumers. This shift may not only attract a broader customer base but also encourage existing consumers to make healthier choices.

Expansion of Retail Channels

The frozen pizza market in Japan benefits from the expansion of retail channels, including supermarkets, convenience stores, and online platforms. This diversification allows consumers greater access to a wide range of frozen pizza products. In recent years, the number of retail outlets offering frozen pizzas has increased significantly, with convenience stores reporting a 15% rise in sales of frozen food items. The frozen pizza market is capitalizing on this trend by enhancing distribution strategies and ensuring product availability across various platforms. As e-commerce continues to grow, online grocery shopping is expected to further boost the market, providing consumers with the convenience of purchasing frozen pizzas from home.

Rising Demand for Quick Meals

The frozen pizza market in Japan experiences a notable increase in demand for quick meal solutions. As lifestyles become busier, consumers seek convenient food options that require minimal preparation time. This trend is reflected in the growing sales of frozen pizzas, which are perceived as a hassle-free meal choice. In 2025, the market is projected to grow by approximately 8% as more households opt for frozen pizzas over traditional cooking methods. The frozen pizza market is adapting to this demand by offering a variety of flavors and sizes, catering to different consumer preferences. This shift towards convenience is likely to continue, as more individuals prioritize time-saving meal options in their daily routines.

Innovative Packaging Solutions

The frozen pizza market in Japan is witnessing a shift towards innovative packaging solutions that enhance product appeal and convenience. Eco-friendly packaging options are becoming increasingly popular, as consumers show a preference for sustainable products. In 2025, it is estimated that around 30% of frozen pizza products will feature environmentally friendly packaging. This trend not only aligns with consumer values but also helps brands differentiate themselves in a competitive market. The frozen pizza market is responding to this demand by investing in research and development to create packaging that preserves product freshness while minimizing environmental impact. Such innovations may attract environmentally conscious consumers and drive sales.

Growing Interest in Gourmet Options

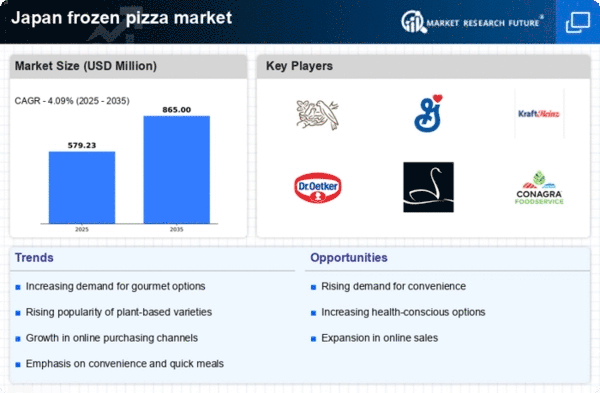

The frozen pizza market in Japan is experiencing a growing interest in gourmet options, as consumers seek higher quality and unique flavor profiles. This trend is reflected in the introduction of artisanal frozen pizzas that feature premium ingredients and innovative toppings. In 2025, the market for gourmet frozen pizzas is expected to grow by 12%, indicating a shift in consumer preferences towards more sophisticated meal choices. The frozen pizza market is responding by collaborating with renowned chefs and food brands to create exclusive offerings that appeal to discerning customers. This focus on quality and uniqueness may enhance brand loyalty and attract new consumers.