Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is reshaping the Japan financial analytics market. Organizations are increasingly migrating their analytics operations to the cloud to benefit from scalability, cost-effectiveness, and enhanced collaboration. Cloud-based analytics platforms allow firms to access real-time data and insights from anywhere, facilitating agile decision-making. Recent surveys indicate that over 60 percent of Japanese financial institutions are adopting cloud solutions for their analytics needs. This trend is expected to drive the market for cloud-based financial analytics tools, which is projected to grow at a compound annual growth rate of approximately 15 percent over the next few years. The flexibility and efficiency offered by cloud solutions are likely to become a cornerstone of financial analytics strategies in Japan.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Japan financial analytics market. These technologies enable organizations to process and analyze large datasets more efficiently, leading to enhanced predictive capabilities and improved risk management. For instance, financial institutions are increasingly adopting AI-driven analytics to detect fraudulent activities and assess credit risks more accurately. The market for AI in financial services in Japan is expected to reach approximately 1.5 billion USD by 2026, reflecting a significant investment in technological advancements. This integration not only streamlines operations but also provides a competitive edge, as firms that leverage these technologies can make more informed decisions and respond swiftly to market changes.

Regulatory Compliance and Risk Management

Regulatory compliance remains a critical driver in the Japan financial analytics market. With stringent regulations imposed by the Financial Services Agency (FSA) and other governing bodies, financial institutions are compelled to adopt robust analytics solutions to ensure compliance and mitigate risks. The implementation of the Financial Instruments and Exchange Act necessitates comprehensive reporting and transparency, prompting firms to invest in analytics tools that facilitate compliance monitoring. As a result, the market for compliance analytics is projected to grow significantly, with estimates suggesting a growth rate of around 10 percent annually. This focus on regulatory compliance not only safeguards institutions against penalties but also enhances their reputation and trustworthiness in the eyes of stakeholders.

Growing Demand for Data-Driven Decision Making

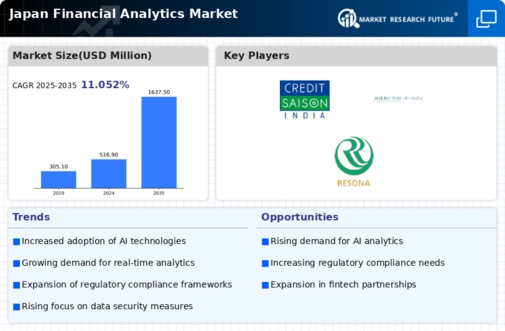

The Japan financial analytics market is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and strategic planning. According to recent statistics, approximately 70 percent of Japanese firms are investing in analytics tools to improve their decision-making processes. This trend is driven by the need to remain competitive in a rapidly evolving market landscape. As businesses seek to harness insights from vast amounts of data, the financial analytics sector is poised for growth, with projections indicating a compound annual growth rate of around 12 percent over the next five years. This growing demand underscores the importance of financial analytics in shaping business strategies and optimizing performance.

Rising Importance of Customer Experience Analytics

The rising importance of customer experience analytics is becoming a pivotal driver in the Japan financial analytics market. As competition intensifies, financial institutions are increasingly focusing on understanding customer behavior and preferences to enhance service delivery. Analytics tools that provide insights into customer interactions and satisfaction levels are gaining traction. Recent data suggests that approximately 65 percent of Japanese banks are investing in customer experience analytics to tailor their offerings and improve client engagement. This emphasis on customer-centric strategies is expected to propel the growth of the financial analytics market, with projections indicating a potential increase in market size by 20 percent over the next five years. By leveraging customer experience analytics, firms can foster loyalty and drive revenue growth.