Government Initiatives and Support

Government initiatives aimed at promoting financial inclusion and digitalization are playing a crucial role in shaping the India financial analytics market. Programs such as Digital India and the Pradhan Mantri Jan Dhan Yojana have facilitated greater access to financial services for underserved populations. These initiatives have resulted in an influx of data that requires sophisticated analytics for effective management and utilization. The government's focus on enhancing the financial ecosystem encourages financial institutions to adopt analytics solutions to comply with regulatory requirements and improve risk management practices. As a result, the financial analytics market is likely to witness accelerated growth driven by supportive policies and frameworks.

Increased Focus on Risk Management

The heightened focus on risk management within the financial sector is a significant driver of the India financial analytics market. Financial institutions are increasingly recognizing the importance of identifying, assessing, and mitigating risks associated with their operations. The implementation of stringent regulatory frameworks has necessitated the adoption of advanced analytics tools to ensure compliance and enhance risk assessment capabilities. According to industry reports, the demand for risk analytics solutions is expected to rise as organizations seek to safeguard their assets and maintain regulatory compliance. This trend is likely to propel the growth of the financial analytics market, as institutions invest in technologies that provide comprehensive risk insights.

Expansion of Digital Financial Services

The rapid expansion of digital financial services in India is significantly influencing the financial analytics market. With the increasing penetration of smartphones and internet connectivity, more consumers are engaging with digital banking and financial platforms. This shift has led to a surge in data generation, necessitating robust analytics solutions to interpret and utilize this information effectively. The Reserve Bank of India has reported a substantial increase in digital transactions, which underscores the growing reliance on data analytics for understanding consumer behavior and preferences. Consequently, financial institutions are investing in analytics tools to enhance customer experiences and optimize service delivery, thereby driving growth in the financial analytics market.

Emergence of Advanced Analytics Technologies

The emergence of advanced analytics technologies, including artificial intelligence and machine learning, is transforming the landscape of the India financial analytics market. These technologies enable organizations to process vast amounts of data efficiently and derive actionable insights. The integration of AI-driven analytics tools allows financial institutions to enhance their predictive capabilities, optimize operations, and improve customer engagement. As businesses increasingly adopt these technologies, the financial analytics market is poised for substantial growth. Market Research Future suggest that the adoption of advanced analytics could lead to a more competitive financial sector, as organizations leverage data to drive innovation and improve service delivery.

Growing Demand for Data-Driven Decision Making

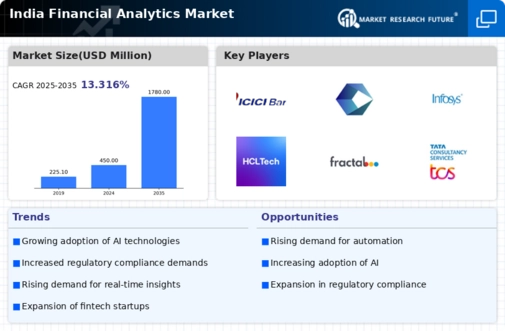

The increasing emphasis on data-driven decision making is a pivotal driver in the India financial analytics market. Organizations across various sectors are recognizing the value of leveraging data analytics to enhance operational efficiency and strategic planning. According to recent estimates, the financial analytics market in India is projected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next five years. This growth is fueled by the need for real-time insights and predictive analytics, enabling businesses to make informed decisions. As companies strive to remain competitive, the adoption of advanced analytics tools becomes essential, thereby propelling the demand for financial analytics solutions in India.