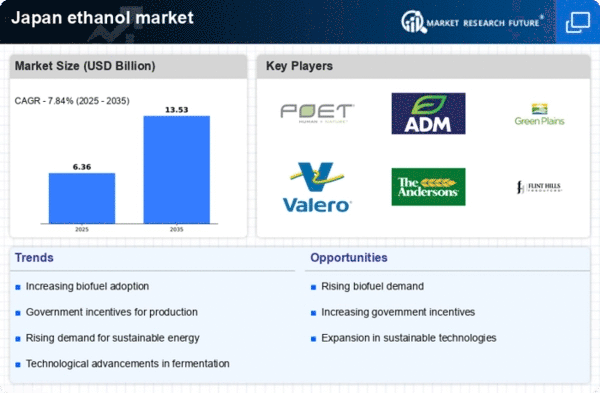

The ethanol market in Japan is characterized by a competitive landscape that is increasingly shaped by sustainability initiatives and technological advancements. Key players such as POET LLC (US), Archer Daniels Midland Company (US), and Valero Energy Corporation (US) are actively pursuing strategies that emphasize innovation and regional expansion. These companies are not only focusing on enhancing production efficiency but are also investing in research and development to create more sustainable ethanol solutions. Their collective efforts contribute to a dynamic environment where competition is driven by the need for cleaner energy alternatives and compliance with stringent environmental regulations.In terms of business tactics, companies are localizing manufacturing processes and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on sustainability initiatives. This competitive structure allows for a diverse range of products and services, catering to the growing demand for renewable energy sources in Japan.

In October Archer Daniels Midland Company (US) announced a partnership with a leading Japanese biofuel firm to develop advanced fermentation technologies aimed at increasing ethanol yield from agricultural waste. This strategic move is significant as it not only enhances ADM's technological capabilities but also aligns with Japan's goals of reducing greenhouse gas emissions. Such collaborations may pave the way for more efficient production methods and a stronger foothold in the Asian market.

In September Valero Energy Corporation (US) launched a new initiative focused on integrating AI-driven analytics into its ethanol production processes. This initiative is expected to optimize operational efficiency and reduce costs, thereby enhancing Valero's competitive edge. The integration of AI technologies reflects a broader trend within the industry towards digital transformation, which is likely to redefine operational paradigms in the coming years.

In August POET LLC (US) expanded its production capacity in Japan by investing in a state-of-the-art facility designed to utilize advanced biotechnologies. This expansion is crucial as it not only increases POET's output but also demonstrates its commitment to meeting the rising demand for sustainable ethanol. The facility is expected to employ innovative processes that minimize waste and energy consumption, further solidifying POET's position as a leader in the market.

As of November the competitive trends in the ethanol market are increasingly influenced by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. Looking ahead, it is anticipated that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition underscores the importance of adaptability and forward-thinking strategies in navigating the complexities of the ethanol market.