Rising Demand for Renewable Energy

The energy storage market in Japan is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources. As the country aims to achieve its ambitious target of generating 36-38% of its electricity from renewables by 2030, the need for efficient energy storage solutions becomes paramount. Energy storage systems play a crucial role in balancing supply and demand, particularly with the intermittent nature of solar and wind energy. In 2023, Japan's renewable energy capacity reached approximately 100 GW, highlighting the growing importance of energy storage solutions to ensure grid stability and reliability. This trend is likely to continue as more renewable projects come online, further driving the energy storage market in Japan.

Increasing Energy Security Concerns

Japan's energy security concerns are driving the growth of the energy storage market. Following the Fukushima disaster, the country has been actively seeking to diversify its energy sources and reduce dependence on imported fossil fuels. Energy storage systems provide a viable solution to enhance energy resilience and security, particularly in the face of natural disasters. The government has recognized the importance of energy storage in achieving a stable energy supply, leading to increased investments in this sector. As of 2025, the energy storage market is expected to expand significantly, as both public and private entities prioritize energy security measures. This trend underscores the critical role of energy storage solutions in Japan's energy strategy.

Regulatory Support and Policy Frameworks

The energy storage market in Japan benefits from a supportive regulatory environment that encourages investment and development. The government has implemented various policies aimed at promoting energy storage technologies, including subsidies and tax incentives for both residential and commercial installations. The Feed-in Tariff (FiT) system has also facilitated the integration of energy storage systems with renewable energy projects. As of 2025, it is estimated that over 1 million households in Japan have adopted energy storage solutions, reflecting the effectiveness of these policies. This regulatory support is likely to continue fostering growth in the energy storage market, making it an attractive sector for investors and developers alike.

Technological Innovations in Energy Storage

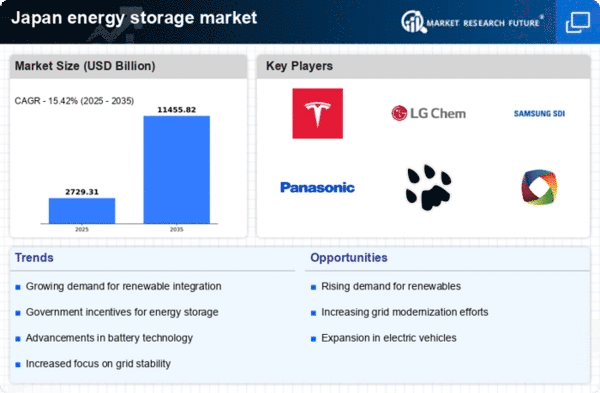

Technological advancements are significantly shaping the energy storage market in Japan. Innovations in battery technologies, such as lithium-ion and solid-state batteries, are enhancing energy density, efficiency, and lifespan. The Japanese government has been actively supporting research and development initiatives, leading to breakthroughs that improve the performance of energy storage systems. For instance, the introduction of advanced battery management systems has optimized energy usage and extended battery life. As of 2025, the energy storage market is projected to grow at a CAGR of 15%, driven by these technological innovations. This growth indicates a robust future for energy storage solutions, as they become increasingly integral to Japan's energy infrastructure.

Growing Interest from Commercial and Industrial Sectors

The energy storage market in Japan is witnessing heightened interest from commercial and industrial sectors. Businesses are increasingly recognizing the benefits of energy storage systems, such as cost savings, demand charge management, and enhanced energy efficiency. In 2025, it is projected that the commercial sector will account for approximately 30% of the total energy storage market share in Japan. This shift is driven by the rising electricity costs and the need for reliable power supply, particularly for manufacturing and technology companies. As these sectors adopt energy storage solutions, the overall market is likely to experience robust growth, further solidifying the importance of energy storage in Japan's energy landscape.