Rising Demand for Automation

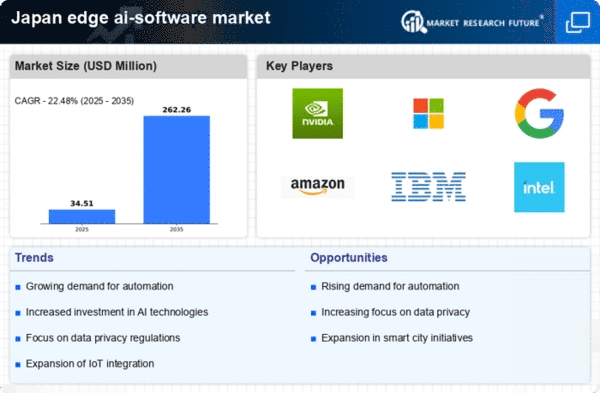

The edge ai-software market in Japan experienced a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and healthcare are increasingly adopting edge AI solutions to enhance operational efficiency and reduce costs. According to recent data, the automation market in Japan is projected to grow at a CAGR of 10% through 2026. This trend indicates a strong inclination towards integrating AI-driven automation tools, which are essential for real-time decision-making and predictive maintenance. As organizations seek to streamline processes and improve productivity, the edge ai-software market stands to benefit significantly from this growing demand for automation, positioning itself as a critical component in the digital transformation journey of Japanese enterprises.

Expansion of 5G Infrastructure

The rollout of 5G technology in Japan is poised to have a profound impact on the edge ai-software market. With its high-speed connectivity and low latency, 5G enables more efficient data processing at the edge, facilitating real-time analytics and decision-making. The Japanese government has invested heavily in 5G infrastructure, with plans to cover 90% of the population by 2025. This expansion is expected to drive the adoption of edge AI solutions, particularly in sectors such as smart cities, autonomous vehicles, and remote healthcare. As organizations leverage the capabilities of 5G, the edge ai-software market is likely to witness accelerated growth, as businesses seek to harness the full potential of edge computing in conjunction with advanced AI technologies.

Emergence of Edge Computing Applications

The edge ai-software market in Japan is witnessing a significant rise in the development of edge computing applications. As organizations increasingly recognize the benefits of processing data closer to the source, there is a growing demand for software solutions that facilitate this shift. Industries such as retail, healthcare, and transportation are exploring edge computing to enhance customer experiences and operational efficiency. Recent studies suggest that the edge computing market in Japan could reach ¥500 billion by 2026. This growth indicates a strong potential for edge ai-software solutions that can leverage local data processing capabilities, enabling faster response times and improved service delivery. As businesses continue to innovate, the edge ai-software market is likely to thrive, driven by the need for efficient and responsive applications.

Growing Need for Data Privacy Compliance

As data privacy regulations become increasingly stringent in Japan, the edge ai-software market faces a growing need for compliance solutions. The introduction of laws such as the Act on the Protection of Personal Information (APPI) necessitates that organizations implement robust data management practices. This regulatory landscape compels businesses to adopt edge AI solutions that ensure data is processed locally, minimizing the risk of breaches and enhancing privacy. The market for data privacy compliance tools is projected to grow by 15% annually, reflecting the urgency for organizations to align with legal requirements. Consequently, the edge ai-software market is likely to expand as companies seek to integrate AI-driven compliance solutions into their operations, ensuring they meet the evolving standards of data protection.

Increased Investment in Smart Manufacturing

Japan's edge ai-software market is significantly influenced by the country's commitment to smart manufacturing initiatives. The government has launched various programs aimed at promoting Industry 4.0, which emphasizes the integration of AI and IoT technologies in manufacturing processes. Recent reports indicate that investments in smart manufacturing technologies are expected to reach ¥1 trillion by 2025. This influx of capital is likely to drive the development and deployment of edge AI solutions that enhance production efficiency, quality control, and supply chain management. As manufacturers adopt these advanced technologies, the edge ai-software market will play a pivotal role in enabling real-time data processing and analytics, ultimately leading to more agile and responsive manufacturing environments.